We are committed to actively promote sustainability throughout Polaris.

Through our portfolio companies, we have a significant combined revenue, thousands of employees and operations in many countries across the world and a responsibility towards a broad range of stakeholders. As we work with our portfolio of companies we are also commited to addressing sustainability in our own organization at Polaris Management.

Key statistics 2022

CEO: Jan Johan Jühl

Chairman: Erik G. Hansen

HQ: Copenhagen, Denmark

# of FTEs: 36

Revenue (DKKm): 135

Revenue (EURm): 18

Management summary

As a fund manager, sustainability is executed through a large number of components that continously need to be developed and adapted. During 2022, we continued this development process at the fund manager level, the portfolio company level and at Polaris Management level.

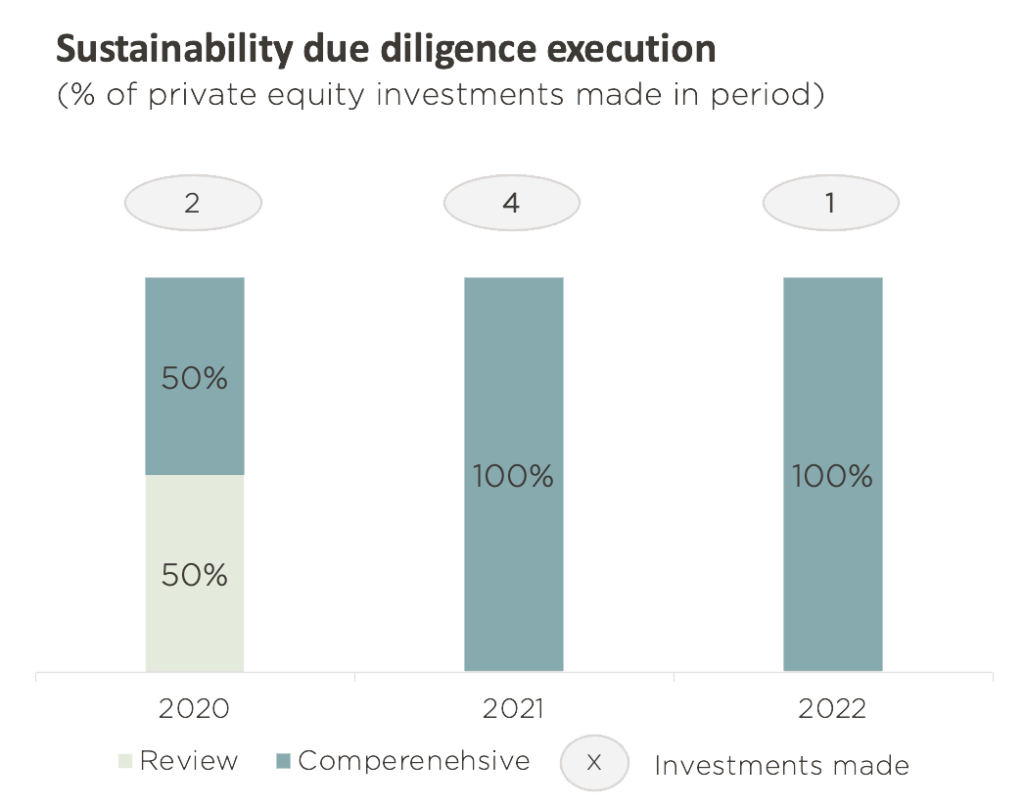

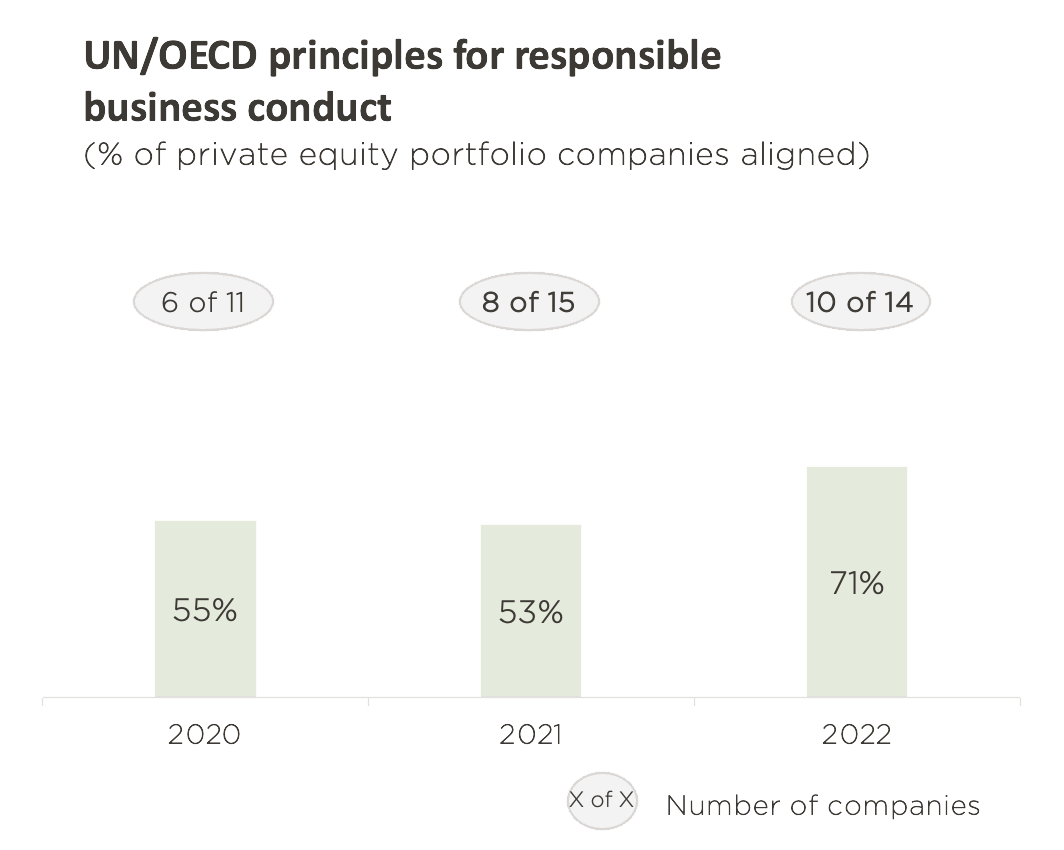

During 2022, we completed our 'Polaris Sustainability Due Diligence' as an integrated part of our investment process in several transactions, which resulted in the investment in Esoft in our Private Equity Strategy. We continue to see increasing interest from the management teams in sustainability and our ability to support them in this area can help make us a more attractive buyer. During the the year, many of our new investments also implemented 'Polaris Sustainabiluty Program' supported by our expert advisors. This includes the implementation of the UN/OECD Guidelines for Responsible Business Conduct and as part of that an impact due diligence to determine each company's impact on environmental, social and economic sustainability. This process provides us and our companies with a definition of sustainability and we are very happy that these guidelines are now being built-into the new EU Regulations: the SFDR, the CSRD, the EU Taxonomy and the upcoming CSDDD. We are continously developing 'Polaris Sustainability Due Diligence' and 'Polaris Sustainability Program' together to ensure they reflect the same underlying standards and guidelines and approach towards sustainabilty. Both are fundamentally based on an assessment of the material impacts of each company which is well in-line with the concept of 'Double Materiality Assessment' in the CSRD.

Martin Bang-Löwgren

Head of Sustainability

Sustainability metrics

Polaris sustainability focus area KPIs

Polaris specific sustainability KPIs

Polaris Management’s contribution to the SDGs

Increasing Positive Impacts

5.5

Supporting gender diversity in Polaris and the private equity industry.

8.8

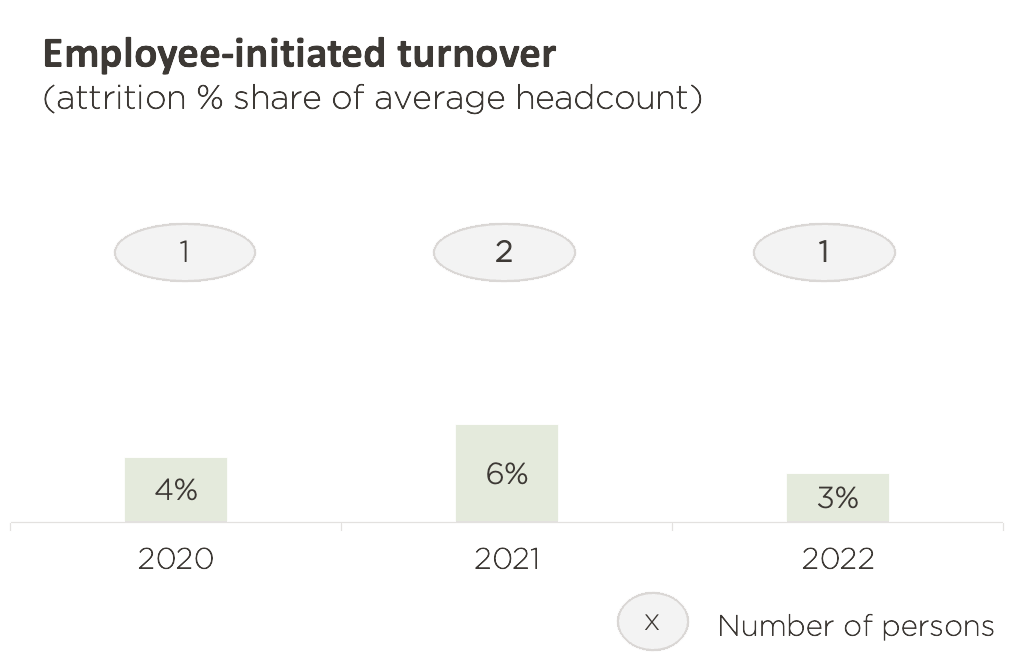

As Polaris is a people business, and our team is imperative to our success, we are committed to ensuring a good working environment.

Minimizing Negative Impacts

13.1

We are commited to minimizing our contribution to climate change by working to reduce our GHG emissions in Polaris as we also do throughout our portfolio of investments. To quantify our impact and identify concrete initiatives to reduce these, we measure and report on both our direct and indirect GHG emissions.

Increasing Positive Impacts

Addressing both positive and negative impacts on sustainability

We address sustainability broadly across our investment process. Through defined selection criteria, we avoid certain types of investments and through a dedicated sustainability due diligence we integrate sustainability considerations in the overall investment evaluation. We consequently work to ensure that we correctly value both actual and potential positive and negative sustainability related impacts from our investments.

Minimizing Negative Impacts

See above

Increasing Positive Impacts

Addressing both positive and negative impacts on sustainability

To improve our portfolio companies’ sustainability practices, Polaris has developed Polaris Sustainability Program. The program details Polaris’ expectations to its portfolio companies when it comes to developing a sustainability strategy and working processes. The program is an integrated part of the Polaris Excellence Model which is Polaris’ structure for active ownership. Our objective is to improve the sustainability performance of all our investments during our ownership by maximising each companies unique positive impacts, minimizing negative impacts and improving our companies sustainability-related infrastructure.

5.5

To support gender equality among our portfolio companies we work to improve the gender balance in the Board of Directors. We also mandate all our portfolio companies to work to improve gender equality in their respective organizations and report their progress.

8.8

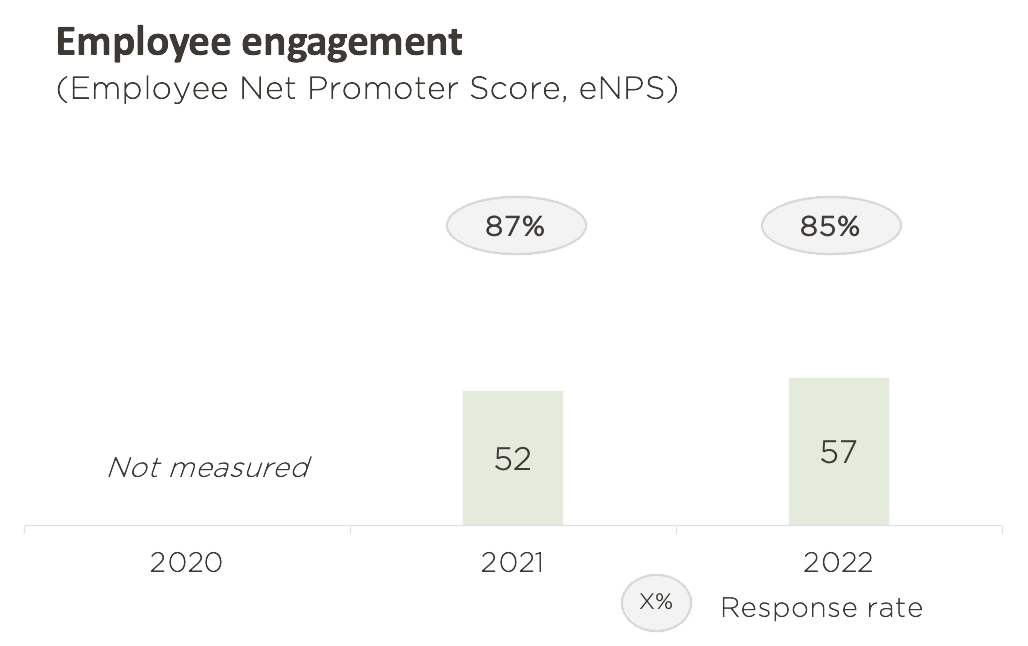

For Polaris as a large employer, ensuring a good working environment is a prioritized area. This focus is formalized as part of our Sustainability Program and made part of the sustainability programs of our portfolio companies who are all asked to work to continously improve their working environment.

Minimizing Negative Impacts

See above

13.1

As part of our commitment to report on and reduce own emissions, we are also committed to reducing the climate impact of our portfolio companies. We are therefore requiring all portfolio companies to report on direct and indirect CO2e emissions, and make a plan for emission reductions. The target for these reductions should be science-based and aligned with the Paris Agreement. Developing a complete inventory of emissions across a portfolio is a large task and we acknowledge that it takes time for each company to develop their footprint reporting and that it will be enriched and improved over time. To make a serious commitment to a science-based target will similarly require time and effort to establish. We will support our portfolio companies to advance these issues as quickly as possible and we support and encourage them to set Science Based Targets for their emission reductions.

Increasing positive impacts

Concrete initiatives in progress

Employee & organization

- Work to support gender equality in the private equity industry in Denmark, Sweden, and Europe

- Ensure a working environment supporting gender equality at Polaris Management

Status on initiatives

Employees & organization

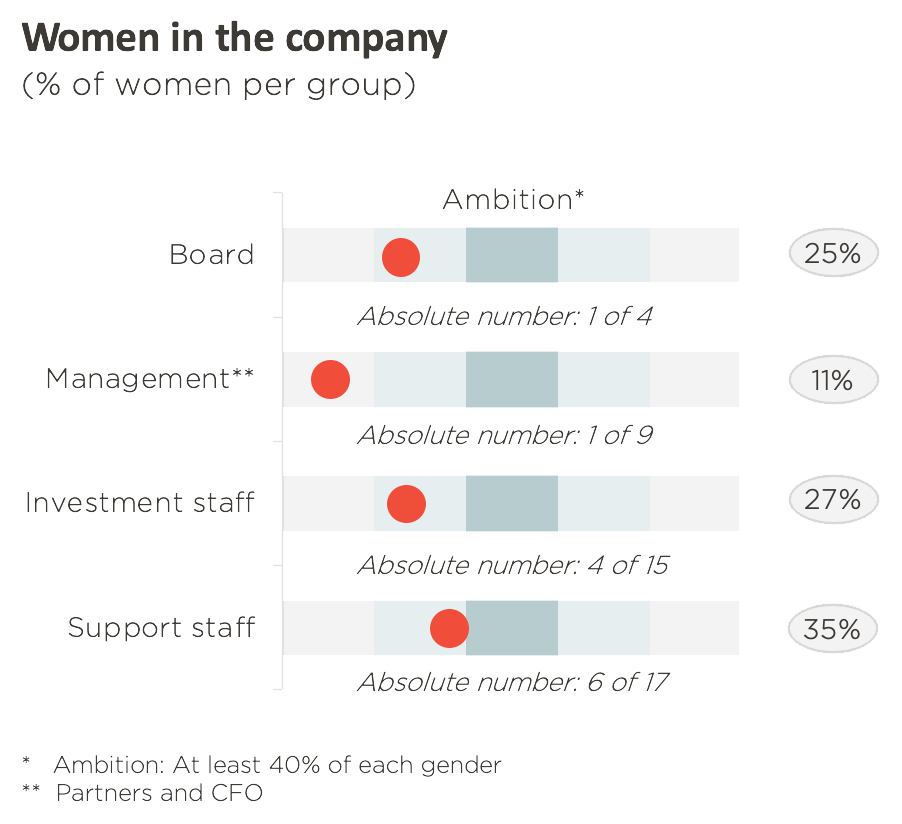

- During 2022, we continued to take an active role in Level 20 in Denmark where we arranged initiatives to attract female talent to the industry. As part of this commitment, we also led the first measurement of gender distribution of the private equity sector in Denmark together with Level 20. We also supported the local organization, Kvinder i Finans, and engaged with Level 20 in the Nordics and in Europe.

- In Polaris, we worked actively with the outcome of the Employee Satisfaction Survey to support improvements in diversity and inclusion. This included the launch of a more extensive and formalized feed-back process to limit bias and ensure equal opportunity.

Concrete initiatives in progress

Active ownership

- Ensure initiatives to improve gender equality in Polaris’ portfolio companies

- Expand Polaris’ female network and recruitment base for projects, board, and management team positions

Status on initiatives

Active ownership

- For the 3rd year we follow-up on gender distribution in our portfolio companies and this topic was made part of the agenda in the portfolio companies that implemented Polaris Sustainability Program in the year.

- We continued to work to recruit more diverse boards and during the year, two female board members joined Futur Pension. The overall gender distribution remained unsatisfactory and will require an intensified effort going forward.

Concrete initiatives in progress

Employee & organization

- Initiative to support employee health

- Process to foster culture of feedback and personal

development

Status on initiatives

Emplyees & organization

- We initiated plans to expand and improve our office and physical working environment.

- Based on the results from our annual Employee Satisfaction Survey and Pulse Checks, we identified areas of improvement. This included continued work with our more extensive and more formalized feedback process. We also ramped up the social activities in the office.

Concrete initiatives in progress

Active ownership

- Ensure initiatives to improve working environment in Polaris’ portfolio companies

Status on initiatives

Active ownership

- With working environment as one of our sustainability focus areas, we included this topic of the board agenda of the new portfolio companies who implemented 'Polaris Sustainabilty Program'

Concrete initiatives in progress

Investment thesis & process

- Integrate sustainability in Polaris’ investment process

Status on initiatives

Investment thesis & process

- Our expanded Sustainability Due Diligence standard was an integrated part of the evaluation processes preceding all the potential investments in the final due diligence process of which one was signed in 2022.

Concrete initiatives in progress

Active ownership

- Ensure that our portfolio companies address relevant sustainability related risks and opportunities and continously improve their performance through implementation of 'Polaris Sustainability Program'.

Status on initiatives

Active ownership

- We continued to implement 'Polaris Sustainability Program', which is part of our Excellence Model, among our portfolio companies and our four most recent investments implemented the program during 2022.

Minimizing negative impacts

Concrete initiatives in progress

Status on initiatives

Employee & organization

- Implement initiatives to reduce climate impact in Polaris Management based on calculations of CO2e emissions

Employees & organization

- We continued to leverage the high level of digital interactions in 2022 which makes a lot of physical travelling unnecessary. Company cars to be replaced with electric vehicles.

Concrete initiatives in progress

Active ownership

- Ensure initiatives to reduce climate impact in Polaris’ portfolio companies based on calculations of CO2e emissions

Status on initiatives

Active ownership

- During 2022, a number of our most recent acquisitions started to measure their CO2 emissions on Scope 1,2 and 3 and get plans in place to reduce these. During the year, the first of our portfolio companies also got their Science Based Target approved by the Science Based Target Initiative (SBTI). Two others are still in process to get their targets validated.

Concrete initiatives in progress

Investment thesis & process

- See “Increasing Positive Impacts”

Status on initiatives

Investment thesis & process

- See “Increasing Positive Impacts”

Sustainability concept applied to Polaris Management

We have applied the same sustainability principles to our own organisation Polaris Management A/S as those we apply to all of our private equity portfolio companies. We have therefor implemented 'Polaris Sustainability Program' in Polaris Management. These are described in more detail in the Polaris Private Equity section of this report.

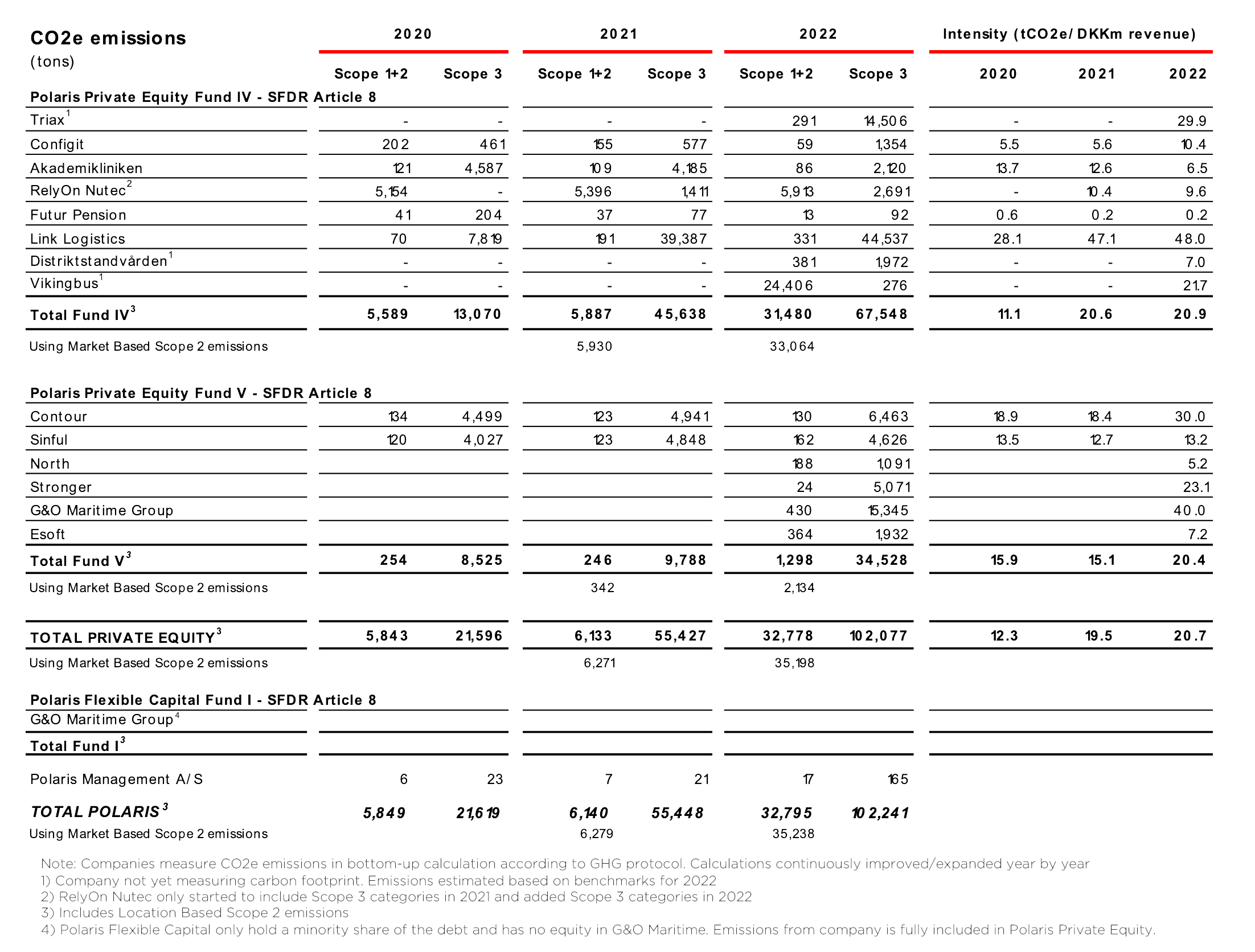

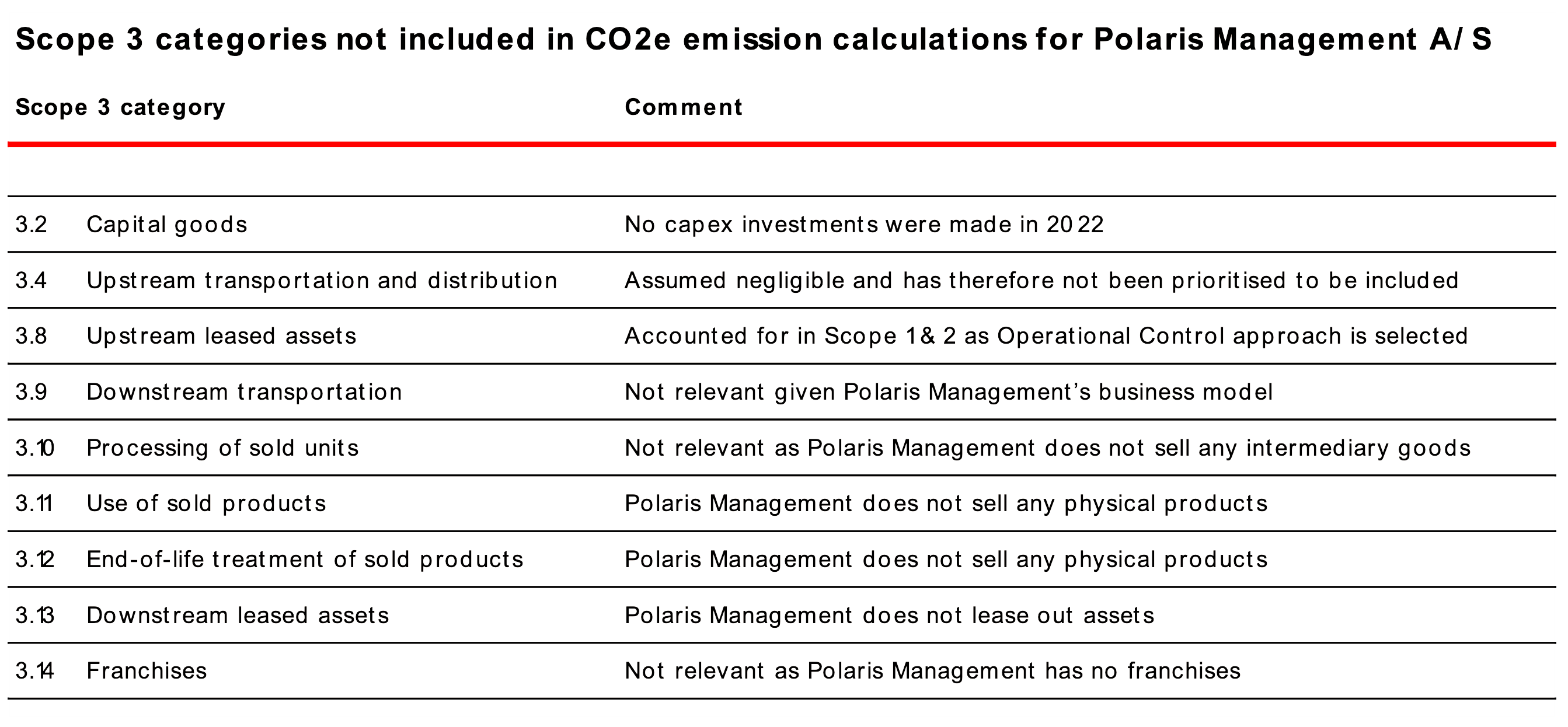

Methodology for CO2e accounting in Polaris Management

As part of the implementation of Polaris Sustainability Program in Polaris Management, we also perform annual CO2e measurements according to the GHG protocol and in-line with the principles applied to our portfolio companies. These are described in more detail in the Polaris Private Equity section of this report.

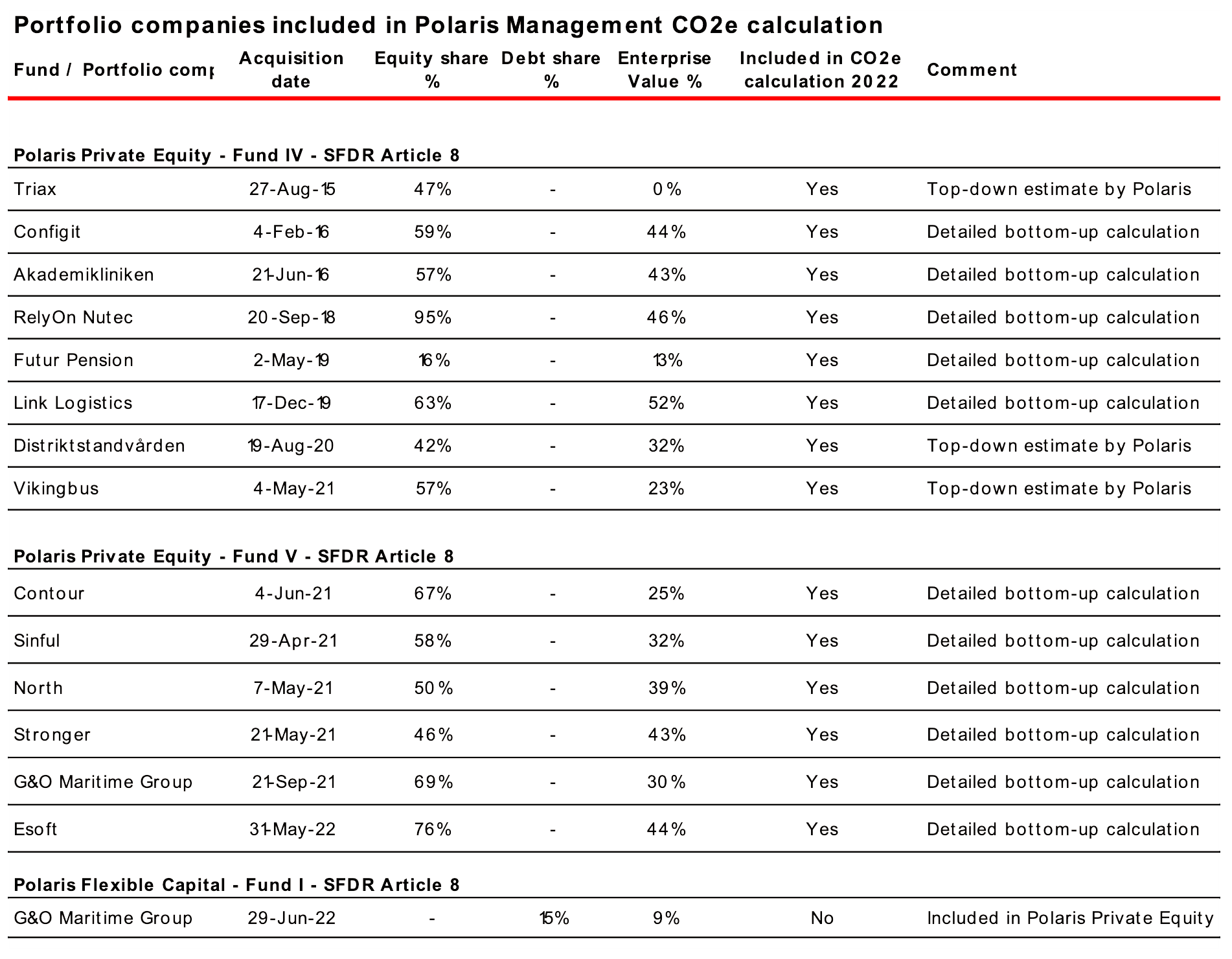

To follow the GHG protocol, we also consolidate the total CO2e emissions for Polaris which, in addition to Polaris Management’s emissions, also include our portfolio companies’ Scope 1, 2 and 3 emissions. Although we do not have majority equity ownership in all portfolio companies, the consolidation approach has been applied to all companies, acknowledging the influence we have across all the companies.

Below you can find the total consolidated emissions for Polaris, an overview of the status of the included companies in the calculation and a list of the Scope 3 categories that have been excluded for Polaris Management.