Polaris Flexible Capital

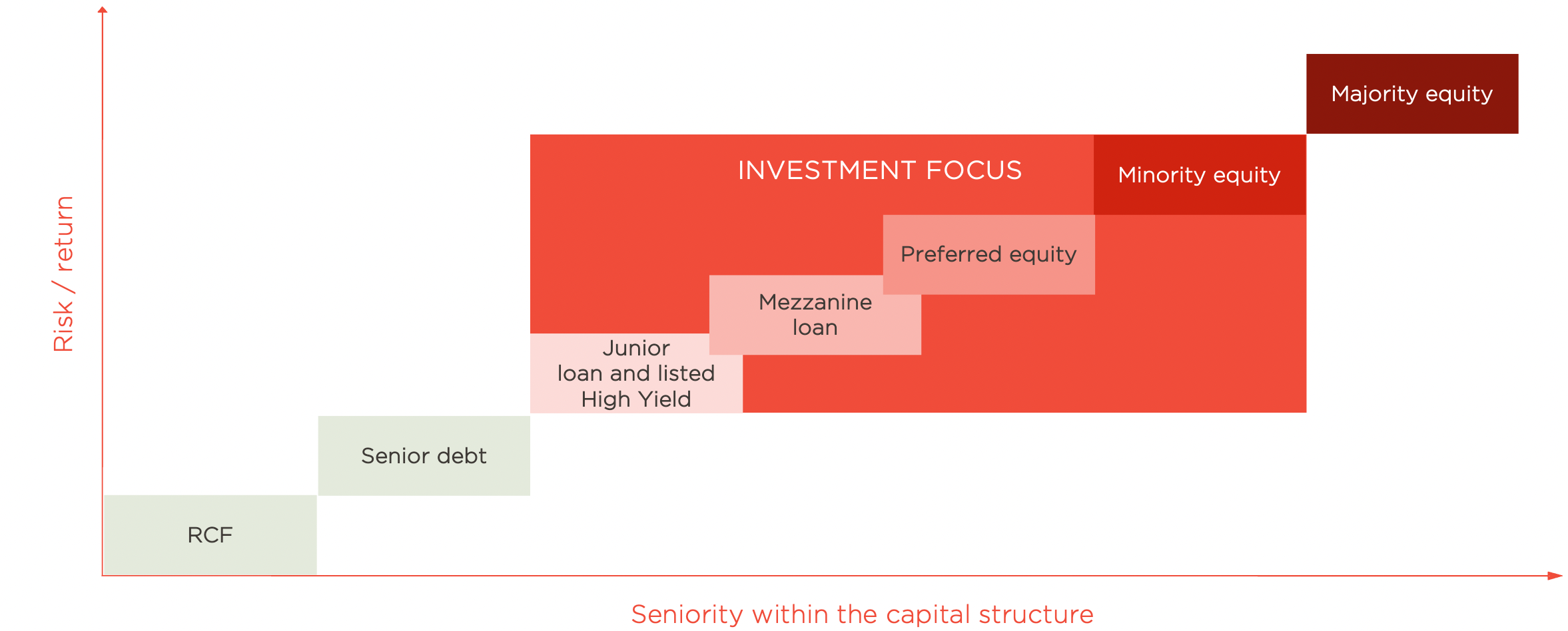

Polaris Flexible Capital I, is an independent closed-end investment fund, which focusses on investments within the junior tiers of the capital structure and minority equity positions.

The fund applies a flexible investment approach and are able to tailor bespoke investments solutions in order to accommodate the specific needs of the companies we partner with.

The investment strategy consists of three main components

1.

Junior loan / Mezzanine / Preferred equity

2.

Minority equity

3.

Opportunistic listed credit opportunities

Video presentation of Polaris Flexible Capital.

In Danish

Tailored financing made possible by applying a Flexible investment strategy

Investment focus across the capital structure

Core focus

Junior financing

Characteristics

Value to the companies we partner with

Core focus

Minority equity

Characteristics

Value to the companies we partner with

Opportunistic

Listed credit opportunities

Characteristics

Rationale

Typical situations...

where PFC can financially facilitate successful corporate development

Growth / transformation

Sponsor-led acquisitions

Special situations

(incl. pre-IPO placements)

Key Investment Criteria

The fund will have a Nordic investment focus and will be looking to make investments with fits the below listed investment characteristic.

Size

Sector / Geography

Credit / investment story

Owner commitment

Investment horizon

Sustainability

Target return

The Polaris Flexible Capital team

Investment Team - Polaris Flexible Capital

Investment support resources

Investment advisory board

Contact details