Portfolio Summary - Polaris Private Equity

The work with sustainability at portfolio level

The work with sustainability throughout Polaris’ private equity portfolio is aligned with Polaris Sustainability Program, either through a direct implementation of the program together with Polaris recommended advisors or through comparable and fundamentally aligned processes, yielding similar outcomes and including the same mandatory components. We aim to implement this structure as soon as practically possible and preferably within 12 months after the closing of an acquisition. For the program to be successful and drive real change it is however critical that the project is firmly anchored in the management team and Board of Directors and can be supported by sufficient resources and a sustainability responsible in the company. The implementation of the program might therefor sometimes need to be postponed beyond our target of 12 months until these factors are in place.

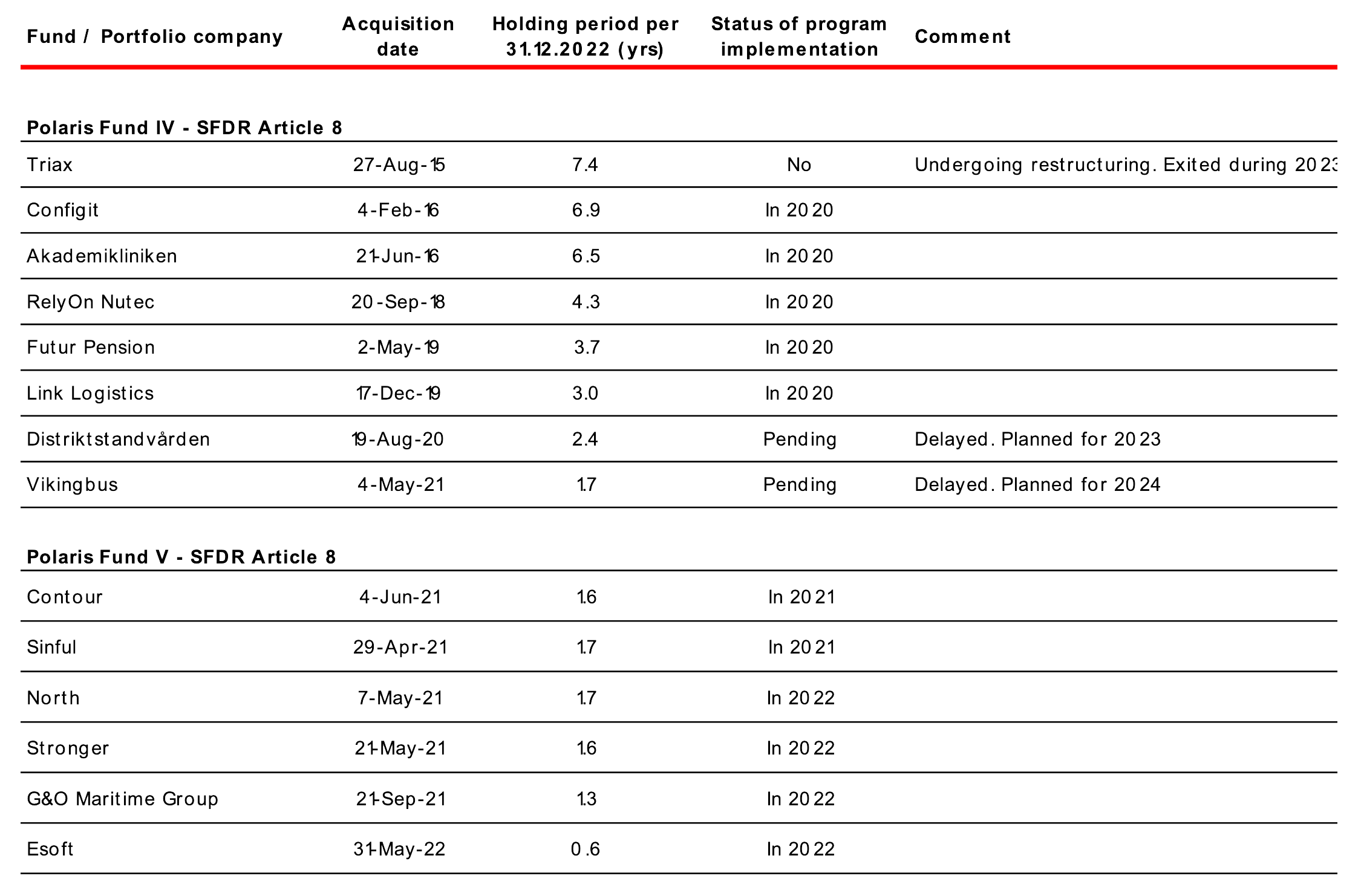

As Polaris Sustainability Program was launched during 2020, we are still working to include all our private equity portfolio companies and at the end of 2022, eleven of our fourteen private equity investments had implemented the program.

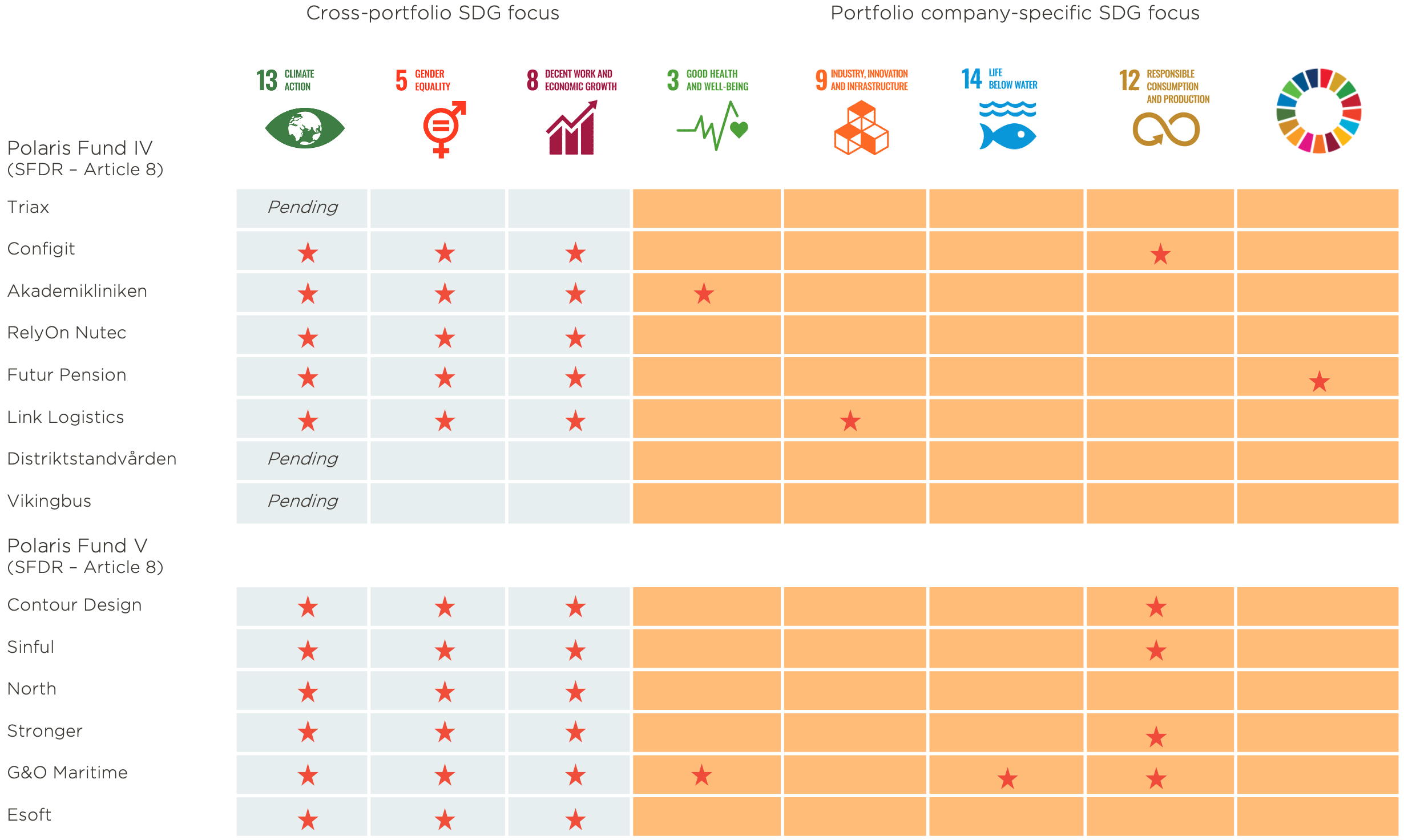

Portfolio company impact on the Sustainable Development Goals - the SDGs

Our work with mapping the portfolio companies’ impacts, positive as well as negative, to the SDGs is used as a way to prioritize, focus our actions and communicate on progress. As mentioned earlier we have chosen to focus especially on three SDGs that we work with and report on across all portfolio companies: Climate Action, Gender Equality and Employer Responsibility.

Implementation status of Polaris Sustainability Program

Climate Action in Polaris’ portfolio

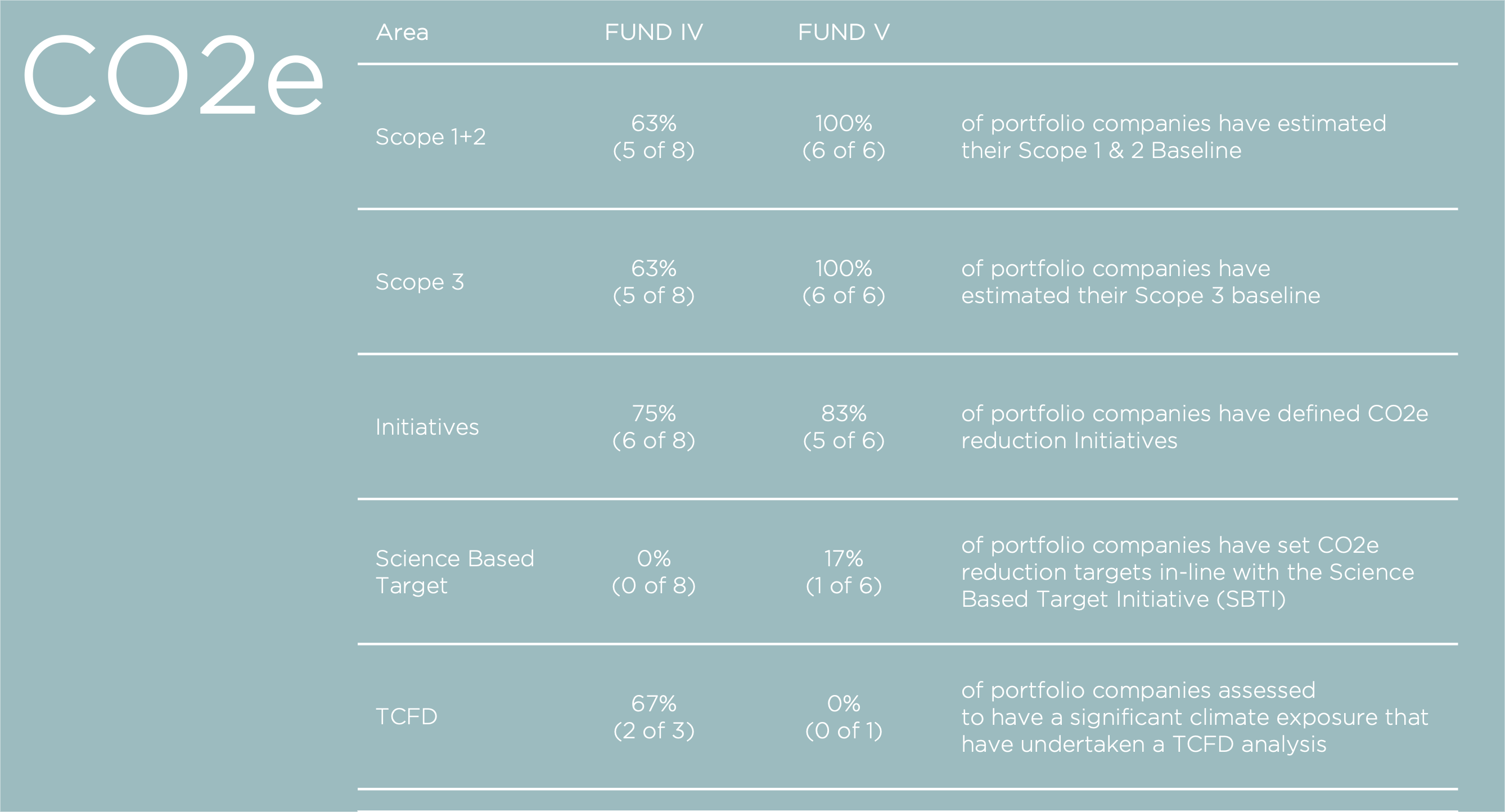

Our focus on Climate Action is based on measuring and tracking the CO2e emissions of our portfolio companies on an annual basis. By doing this we create transparency and ensure that the footprint of the portfolio companies can be addressed, and our portfolio companies actively can work towards reducing their CO2e through identification and implementation of relevant reduction initiatives. We are encouraging and supporting our companies to set reduction targets in-line with the Paris Agreement through Science Based Targets approved by the Science Based Target Initiative (SBTI)

Climate action

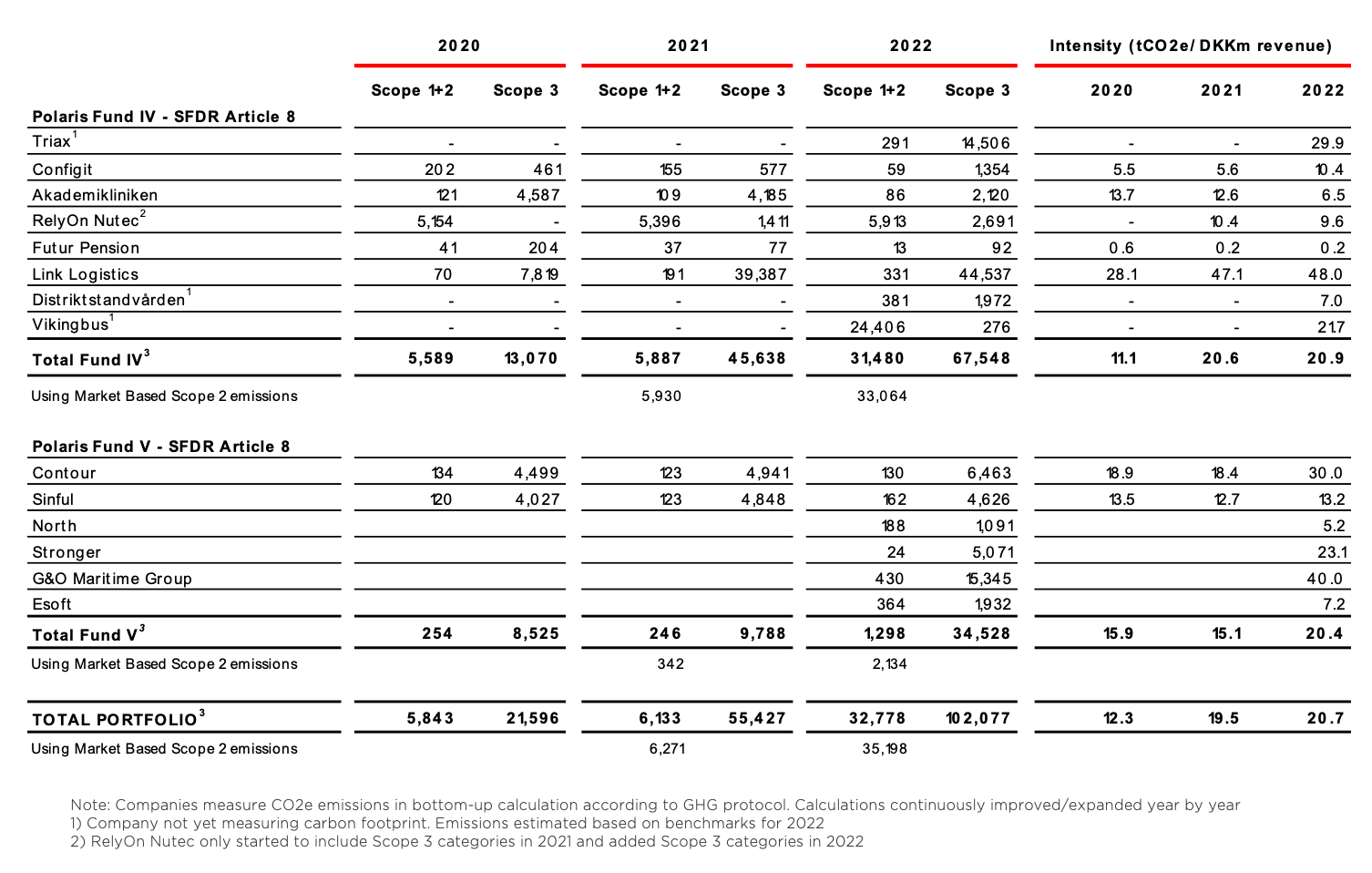

Several new portfolio companies were onboarded during the year and now most of our portfolio companies measure their CO2e emissions on Scope 1,2 and 3 in a thorough bottom-up process and reported their emissions for the year 2022. We continue to believe that this is a necessary foundation to understand your emissions and enable the right initiatives to reduce them. We expect that the companies which do currently not measure their CO2e emissions will do so in the near future. As the measurements are developing and improving in our companies and many have just made their first measurements, it is not yet possible to establish the development of our companies emissions in a meaningful way. We expect this to start to be possible as we move forward.

For the companies not yet reporting on their emissions, we this year made estimates to be able to report on the complete emissions from our private equity investments. The overview below shows that our emissions primarily are generated by our investments in the transportation sector (Link Logistics, Vikingbus) which constituted 52% of total emissions in 2022 while our product-companies generated 35% of our emissions in the period (Triax, Contour, Sinful, Stronger and G&O Maritime). The remaining service businesses only generated a total of 14% of our total emissions in the period. We expect to continue to invest in businesses with a large range of CO2e emission intensities and we will not exclude companies with high emissions on principle as long as we believe it can be responsibly managed and we can support decarbonization. Climate impact, carbon emissions and decarbonization will therefor continue to be an important part of our due diligence process.

During 2022, Contour Design became our first portfolio company to have their Science Based Target approved by the Science Based Target Initiative (SBTI) and we expect more companies to follow. Among them, our largest emitter Link Logistics. We will continue to support our portfolio companies on their journey to reduce their climate impact and set Science Based Targets for their reduction efforts.

Table overview of all absolute emissions (tCO2e)

Gender Equality in Polaris’ portfolio

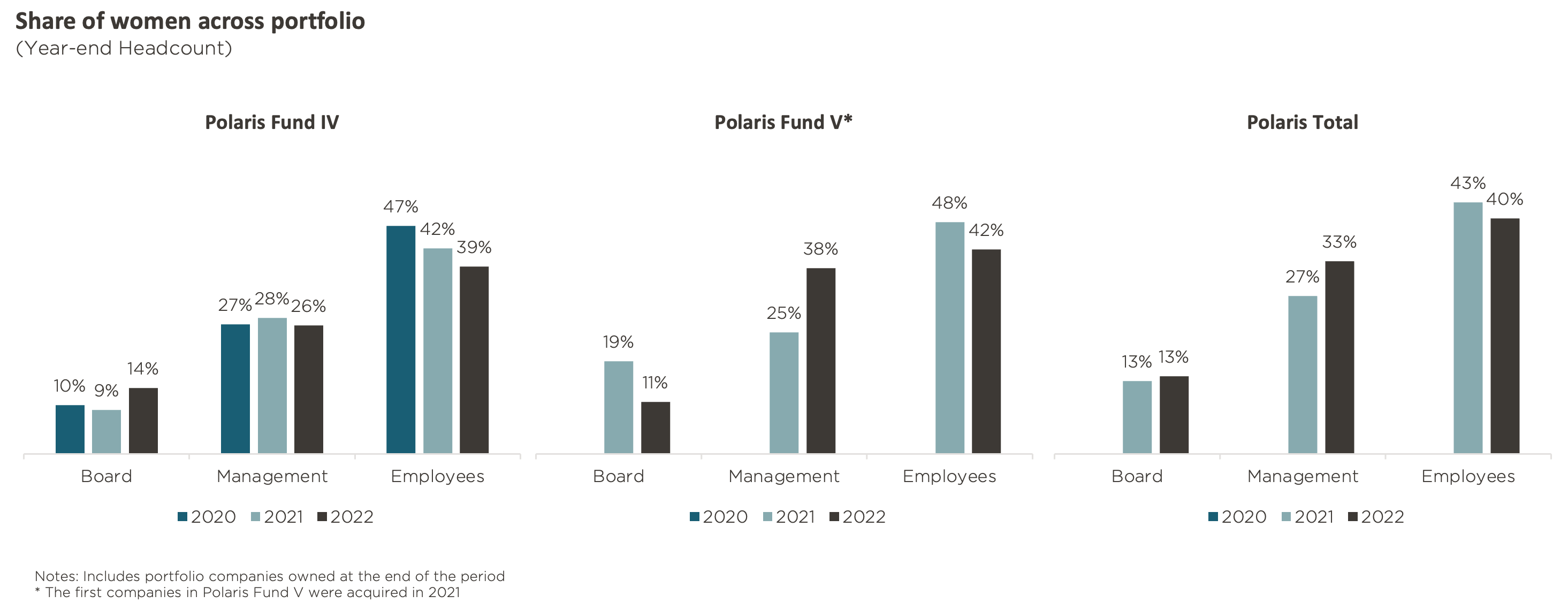

With Gender Equality as a focus area for our work, the share of women on board, management and employee level has been chosen as a cross-portfolio KPI for Polaris. Thus, all portfolio companies are reporting annually on the gender balance across their organization and Polaris will report on this KPI for the portfolio as a whole. The metric measured is share of women across the portfolio companies, and the work is focused on ensuring a balanced workforce and increase the share of the underrepresented gender.

Gender equality

During the year, more and more of our companies established strategies, targets and initiatives to support gender equality and work towards our ambition to reach a 40/60 gender balance across our portfolio for management teams and boards. At the board level, some improvements were made but were countered by some negative developments. We do however expect this to improve in 2023 as we continue to focus on this area in Polaris. Some improvements were made towards improving the gender balance in the management teams. A majority of our companies improved during the year and the share of female management team members increased from 27% to 33%. We still have a long-way to go and will continue to support further improvements as we move forward. As of 2022, we have also started to gather additional indicators related to gender equality and diverisy and inclusion, hereunder unadjusted gender pay-gap, which should further support transparency, understanding and improvements in the area.

Employer Responsibility in Polaris’ portfolio

Being good employers through respect for and protection of labor rights and providing safe, secure and healthy working environments for all employees is not only the right thing to do, but also key to value creation in our portfolio companies as it supports attraction and retention of talents and resources.

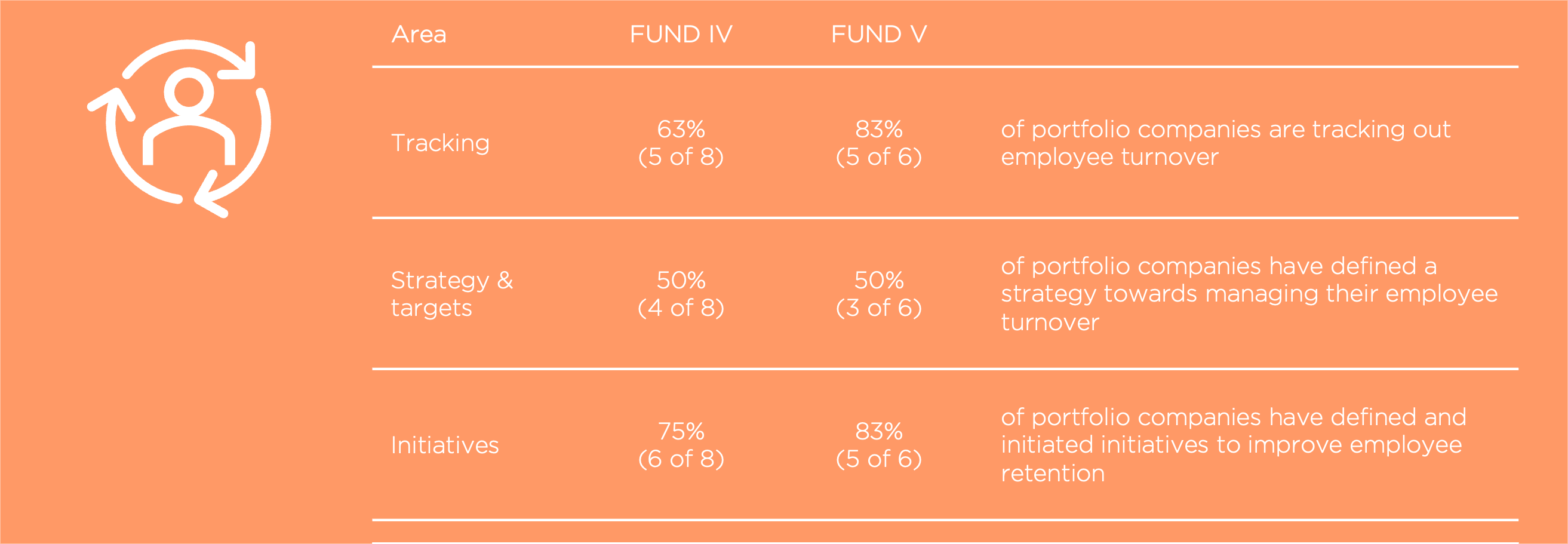

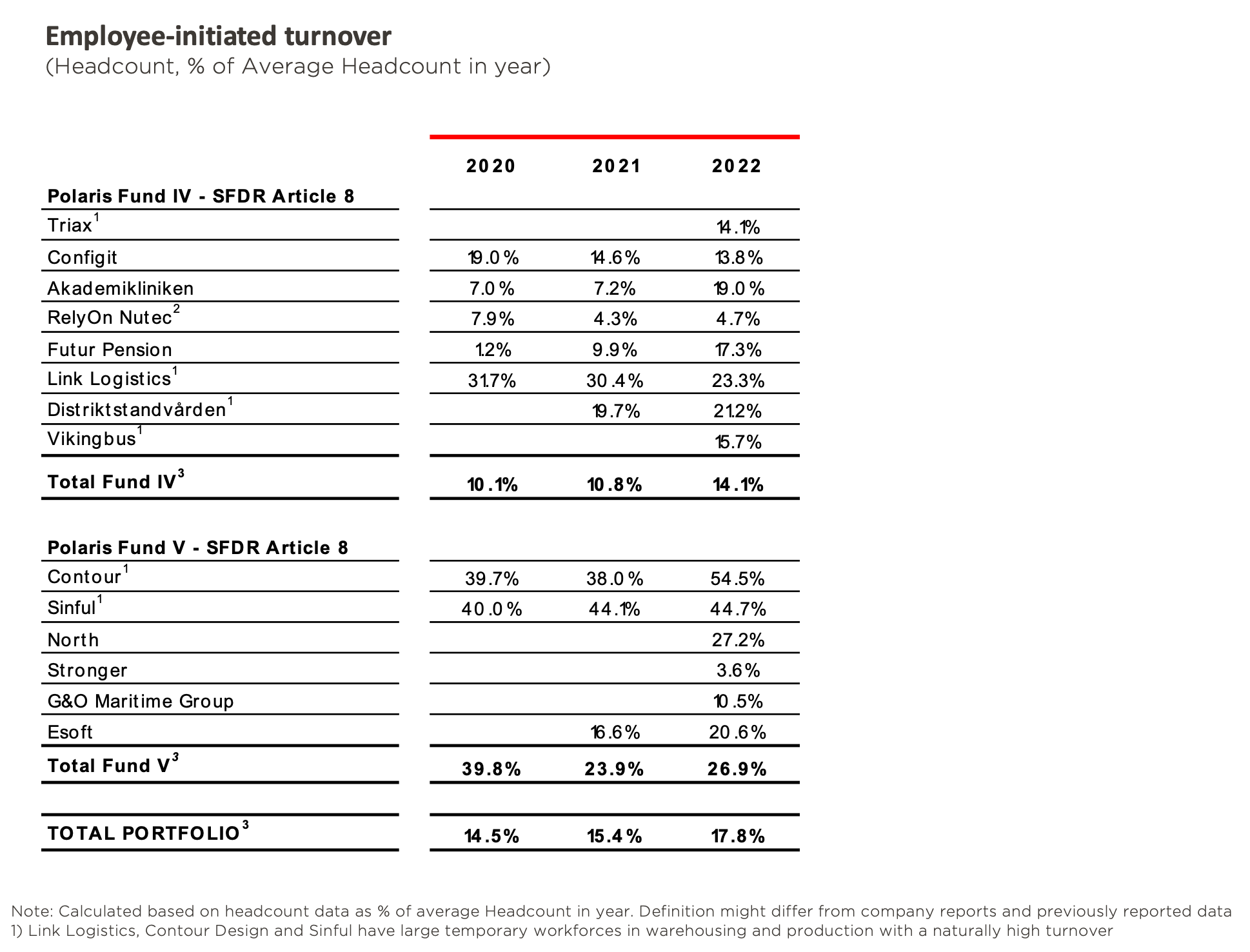

Employee turnover

All Polaris' private equity portfolio companies focus on creating a good and safe working environment for their employees. Measuring and monitoring their Employee-initiated employee turnover is a part of this work which is often complemented by a range of other measures. For the year 2022, we also started to gather data on additional indicators in this area, such as employee satisfaction, absenteisme, accidents among others. As these measurements mature, some might also be included in future reporting.

We continue to see a large variance in the employee turnover throughout our portfolio due to structural differences between our portfolio companies. Link Logistics, Contour and Sinful with large groups of temporary employees in manufacturing and warehousing continue to report a structurally high turnover. During the year, both Akademikliniken and Futur Pension reported an increased turnover in the period which was linked to organizational developments in each company and is well understood and managed by the respective organization. Overall, we are confident that the employee turnover is managed responsibly by each portfolio company and we will continue to support them in this effort.

Overview of portfolio impact on the SDGs

As part of Polaris Sustainability Program, our portfolio companies map their material positive and negative impacts of our portfolio related to the UN’s Sustainable Development Goals (SDGs). All impacts to the SDGs have been linked to the sub-goals and related business actions formulated by the Global Reporting Initiative (GRI) to make this work as concrete and actionable as possible. Subsequently the portfolio companies have formulated initiatives to increase positive and minimize negative impacts.

Portfolio company sustainability reporting

Our Scope

We are applying our sustainability strategy for all our private equity investments in all active funds in this strategy, Fund IV and V. These two funds constituted 96% of our total invested capital in Polaris and included fourteen portfolio companies at the end of 2022. This includes all companies acquired by Polaris Private Equity that remained in our ownership at the end of the period, of which the earliest was acquired in 2015.

We align our work with established standards and frameworks.

Our sustainability program is based on international standards and frameworks to ensure that the way we work and report is in alignment with best practices in the field. By this we also seek to support quantitative and concrete approaches with a focus on materiality. The standards and frameworks used are described throughout this section along with how the work is conducted.

Methodology for CO2e accounting

Sustainability KPI identification

Core sustainability KPIs

Three core sustainability KPIs have been selected and will be reported on across portfolio companies following SASB standard reporting practices (please see below section for more information on SASB). The Core sustainability KPIs are:

Company specific sustainability KPIs

Each portfolio company should select at least three company specific sustainability KPIs that are relevant for their business and their material impacts. The primary concern is to identify an indicator which is the most relevant for the specific company but if possible, we aim to use indicators defined by the SASB standard reporting practices.

The sustainability accounting standards boards' (SASB) materiality map

is based on studies of 77 industries and more than 4000 cases to identify relevant disclosure topics across different industries and sectors.

To ensure that we measure sustainability in a manner that is material, manageable and relevant to the individual portfolio company, and acknowledging that our portfolio is very diverse, each company goes through a process to select, at least, three sustainability KPIs that are specific for their company in addition to the three core sustainability KPIs.

A key priority during this process has been to ensure relevance and materiality in the KPIs selected based on the industry of the specific portfolio company. As a starting point, the KPI selection process includes a review of relevant SASB’s materiality maps.

The SASB materiality maps have been chosen as the starting point for this process since it is a broadly accepted and well-founded standard to guide the disclosure of financially material sustainability information by companies to their investors. The approach is focused on identifying quantitative and qualitative measures that are likely to impact a company’s financial performance and at the same time provides an industry-specific lens in recognition of the fact that the issues most likely to impact financial performance vary by industry. The SASB standard can therefore provide us with market-informed material sustainability measures, but also help us increase sustainability transparency towards our investors and future owners of our portfolio companies.

In some cases, we have adapted the SASB KPIs to better reflect the reality of the specific companies operations and adjusted the KPIs to a Nordic context rather than the American context in which the SASB materiality map is originally developed. If we are not able to indentify a suitable SASB KPI, we try to align with other standards such as the Global Reporting Initiative (GRI) or indicators embedded in the new EU regulations: SFDR and CSRD. We will in the end prioritise materiality and relevance from the companies perspective and it might therefor in some cases be necessary to structure proprietary indicators.

All portfolio companies are tasked with setting targets for the cross-portfolio sustainability KPIs as well as for the company-specific KPIs. Some portfolio companies have completed this process already while other are still in the process of developing the initiatives associated with their efforts to improve on the KPIs, why target setting is still an ongoing process.

Business reporting on the SDGs: An analysis of goals and targets

is a report developed in a partnership between Global Reporting Initiative (GRI) and the UN Global Compact with technical and strategic support provided by PwC. The report consolidates guidance on how businesses can contribute to the SDGs by providing an illustrative list of possible actions that businesses can take to

make progress towards the individual sub-targets.

Our contribution to the UN Sustainable Development Goals

The UN Sustainable Development Goals (SDGs) provide a framework for informing and communicating our work with sustainability. We use the SDGs as a way of creating transparency around our positive and negative impacts and how we are working with these. All portfolio companies have gone through a process to identify their significant contributions to the SDGs. In this process both positive and negative impacts have been identified and discussed. It has been of high importance that the approach to working with the SDGs is as realistic, holistic and transparent as possible. We also want to ensure that we focus on both work towards increasing our positive impacts and on minimizing our negative impacts and being transparent in how we work towards doing so.

We are taking a conservative approach to working with the SDGs, meaning that we focus on and work with our material impact. Therefore we have encouraged our portfolio companies to rather focus on fewer SDGs and work more in depth with the areas of material impact, than falling for the temptation to claim positive impacts across a wide range of SDGs.

It is very important for us to be clear about the fact that even if a portfolio company is not fundamentally changing the world, we are taking responsibility for our negative impacts. We are focused on ensuring businesses are run in a sustainable way – both internally and externally. This realization is important and necessary for us and the portfolio companies to focus our efforts on the areas where we can achieve real impact and where it matters the most.

In order to link our work with the SDGs to actual initiatives and actions to the greatest extent possible, we have based our approach on Global Reporting Initiative’s (GRI) Business Reporting on the SDGs: An Analysis of Goals and Targets. As a consequence, the portfolio companies have addressed the sub-target level of the SDGs in their work. For the selected sub-targets we have assessed the associated business actions of the sub-targets in order to identify where the companies can have a real impact in line with these.

For each identified area of material impact we have identified the associated concrete initiatives that the portfolio companies have launched or will launch to increase their positive impacts or minimize their negative impacts. These initiatives have been sequenced and included in the sustainability road map for the portfolio company, which is approved by the individual Board of Directors. Impact tracking on the initiatives will be followed up upon in the Board meetings and status on the initiatives will be included in each companies sustainability reporting.

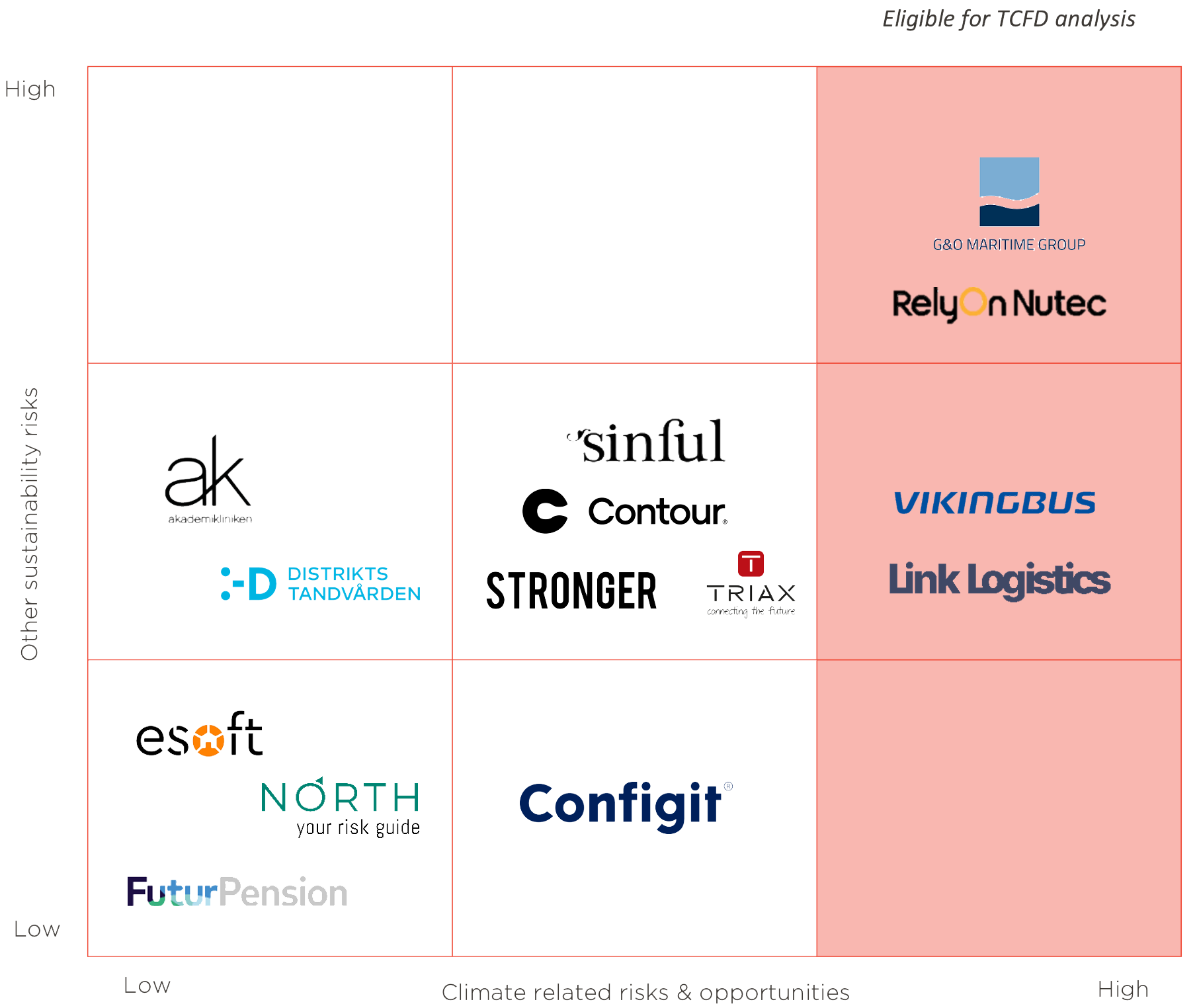

How we are assessing climate risks and opportunities

Our approach to assessing the impact of climate change on our portfolio companies from a risk/opportunity perspective is based on the Task Force on Climate- related Financial Disclosures’ (TCFD) risk and opportunity framework.

2022 was the third year where TCFD as a structured, formalized approach was introduced to our work with climate-related risks and opportunities and the work has been launched as a phased roll-out approach. To prioritize efforts we have conducted a high-level assessment of each of the portfolio companies included in this report and prioritized the companies according to estimated exposure to climate changes. The portfolio companies believed to be most exposed to climate-related risks and opportunities have been prioritized. These companies are analysed from an outside-in perspective of each of the topics in the TCFD risk and opportunity framework. The result of this high-level assessment can be seen in the TCFD prioritization matrix below where the companies initially prioritized for the TCFD analysis are to be found on the right hand side of the matrix.

Another element of our phased approach to climate-related risk and opportunity assessments is that this first step in working with TCFD has been primarily qualitative, where all topics in the risk and opportunity framework initially have been addressed and where possible supported findings with quantitative analyses have been carried out. At this first step of working with TCFD we have not carried out structured scenario analyses, but will work towards expanding our approach to further strengthen the efforts with scenarios in the coming years. For the portfolio companies that have gone through the climate risks and opportunity assessment, the process has been initiated by a high-level assessment of each risk and opportunity topic followed by a prioritization of where to conduct deep-dive analyses to increase depth of analyses and increase the transparency of the impact on the company. As part of the TCFD analyses the companies have conducted analyses of e.g. expected CO2e tax scenarios based on their calculated CO2e baselines and the carbon tax recommendations put forward by the Danish Climate Council and IMF in relation to a 1.5 and a 2 degree scenario. Following the analyses, initiatives to address the key risks and opportunities identified have been formulated. These initiatives have been prioritized and aligned with the overall strategy of the company and other organizational priorities and presented as part of the consolidated sustainability roadmap for Board approval. Each portfolio company should revisit their TCFD analysis on an annual basis to ensure continuous focus on climate-related risks and opportunities and identify any relevant changes in relation to these.

At Polaris, we have formally integrated the TCFD framework as a structured approach to assessing climate-related risks and opportunities in our due diligence process. Hence, for all investments made in Fund V, a separate assessment of the individual investment case's exposure to climate changes has been carried out in addition to the other sustainability analyses conducted in our due diligence process. This analysis is an important element of the overall sustainability assessment of the investment case and the decision foundation for the investment committee in Polaris Management.

TCFD prioritization matrix

Polaris sustainability principles define responsible business conduct

based on the UN Guiding Principles on Business and Human Rights and the OECD Guidelines for Multinational Enterprises. These Principles are the foundation for making the ten principles

of the UN Global Compact operational and constitute a global minimum standard for responsible business conduct.

Our Sustainability Principles - the Principles of Responsible Business Conduct in our private equity strategy

The ambition for all the portfolio companies in Polaris Private Equity is to align their work with the global minimum standard for responsible business conduct. This work is initiated in a 5-day onboarding process which we aim to initiate within 12 months post the closing of each acquisition as part of 'Polaris Sustainability Program'. The process generates the following content and output, which forms the basis for the formulation of the companies' sustainability strategy:

Impact Assessments/Capacity Development process (5-day onboarding)

- Introduction: Introduction to the global minimum standard for responsible business conduct

- Definition of sustainability: Introduction to the key fundamental elements of sustainability through 84 potential impact areas:

- Environmental impact - 20 areas

- Social impacts - 48 areas (human and labor rights)

- Economic impacts - 16 areas

- Policy commitment: Formulation of a sustainability policy and a formal commitment to the minimum standard for responsible business conduct

- Impact Due Diligence: Implementation of due diligence processes and completion of the first assessment including:

- Identification of potential negative impacts

- Assessment of risk levels, existing actions and additional actions to prevent or mitigate the risks identified, and indicators to measure effectiveness of actions

- Action plans: Listing of coming actions to prevent or

mitigate impacts, estimate of resources and person responsible

- Business relationships: Construction of a Code of Conduct for Business Relationships

- Grievance mechanisms: Outlining the basis for establishment of grievance mechanisms in the company

- Cloud-based tool: The documentation of the outcome and follow-up of the Impact assessments (due diligence) are managed in a dedicated cloud-based tool: CSRCloud

The resulting sustainability policy, business relationship Code of Conduct, impact assessments as part of a management system (due diligence process and governance, action plans and grievance mechanisms) are approved by the company Board of Directors after which the company applies for membership in UN Global Compact.

Following the process, the portfolio company is also able to comply with the EU regulations that directly reference our Sustainability Principles: the SFDR, CSRD, the EU Taxonomy (Minimum Safeguards) and the upcoming CSDDD.