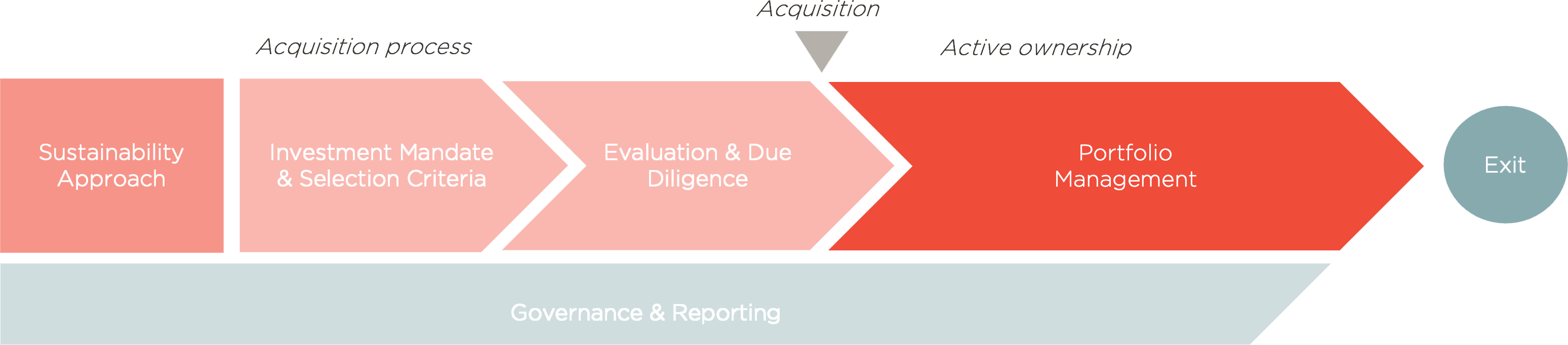

Our commitment to sustainability is operationalized in our Sustainability Strategy and its different components throughout the investment process

The investment process

Sustainability Approach

Outlines how we are working with sustainability and what sustainability means for our investment strategy and process. Our approach also details our focus areas and the international standards and frameworks that we are basing our work on.

Acquisition process

With our Sustainability Approach as the starting point, sustainability is an integrated part of our investment process. Our Investment mandate & selection criteria define what we are willing to invest in and how we screen investment opportunities. Our process for Evaluation & Due Diligence dictates how we evaluate investments prior to an acquisition.

Portfolio Management

Our Portfolio Management process outlines how we are working with sustainability in partnership with our portfolio companies as part of our active ownership. Our ‘Polaris Sustainability Program’ help our companies define the appropriate strategy and is an integrated part of Polaris Excellence Model, which supports value creation in our portfolio companies.

Governance & Reporting

Details how sustainability fits into our overall governance structure, from defining our approach and throughout the acquisition process and active ownership phases to how we measure, track our progress, and communicate around sustainability.

Our Sustainability Approach

Our commitment and rationale

As the fund manager of Polaris’ funds, we at Polaris Management acknowledge that our responsibility stretches beyond our own organization and includes the broader impact we have on all stakeholders of Polaris: the employees, customers, suppliers, and the societies where we and our portfolio companies operate. We are committed to actively promoting sustainability throughout Polaris and do this for two reasons:

- It is a moral imperative – it is the right thing to do

- It is an integrated part of long-term value creation

We promote sustainability by

- Promoting sustainability throughout Polaris and incorporate sustainability considerations into our own operations in Polaris Management as well

as in our investment and portfolio management processes for each of our investment strategies. This is our Sustainability Strategy. - Striving to continuously improve the way we work with sustainability and our sustainability performance both as investors, in our work with our portfolio companies, their management teams and Board of Directors, as well as in Polaris Management.

- Being transparent and reporting on our performance and progress in this Sustainability Report which we publish on an annual basis.

- Working with, and thereby promoting, internationally recognized sustainability standards

- Actively engage in promoting sustainability and transparency around sustainability in the finance sector where we operate.

Our scope

Our sustainability approach sets the direction for our work in Polaris Management. However, as a fund manager, we believe that our main positive, as well as negative, impacts on sustainability derive from the collective actions of our portfolio companies. Therefor, we believe that it is key that all our work with sustainability is integrated in the ongoing work with our companies to promote concrete actions at portfolio company level.

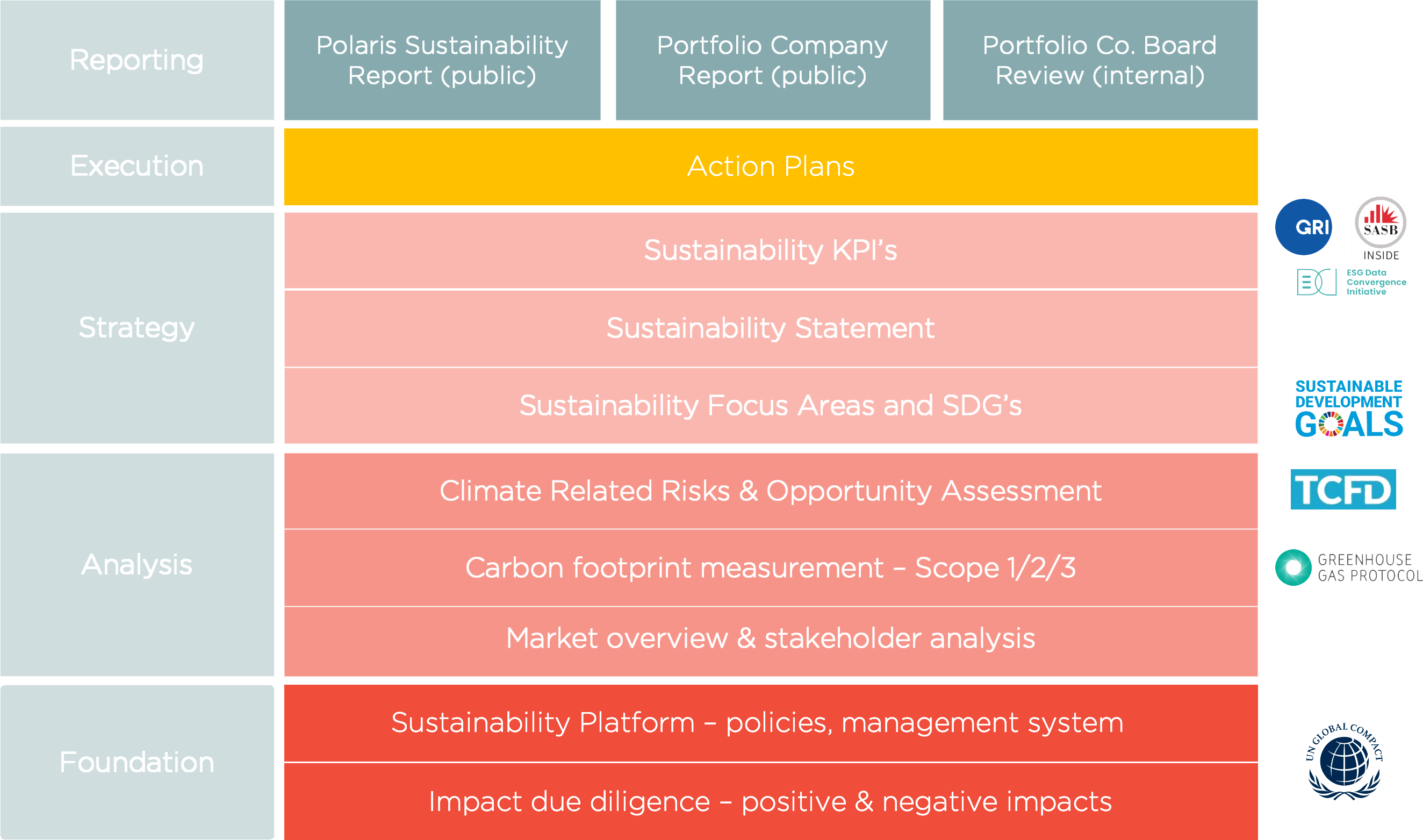

Our approach to sustainability is founded on recognized international standards and concepts and based on these, we have developed an approach to how we believe sustainability should be approached for mid-sized Nordic companies. We call this 'Polaris Sustainability Program'. The program is tailored to allow for company specific considerations and to ensure the most relevance and impact for each company. This is based on our belief that the material sustainability related risks and opportunities are often unique for each sector and often also specific for each company depending on their maturity as well as geographic location, supply chain, business model and culture. For our work to be relevant we must therefore continuously ensure that our sustainability strategy strikes the right balance between standards and minimum requirements and company specific considerations, including maturity, resource availability and ambition level. Our program is well tried and tested in our private equity strategy where we have majority control and it is continously developed. The program also informs our due diligence process and investment mandate.

Our sustainability strategy described in this report is implemented in our work at Polaris Management A/S as a fund manager and investor. The strategy is then operationalized for each of our active investment strategies per the 31st of December 2022 and their respective funds:

- Polaris Private Equity: Majority equity investments

- Fund IV launched in 2015

- Fund V launched in 2021

- Polaris Flexible Capital: Minority equity and junior debt

- Fund I launched in 2021

The active funds managed under these strategies fall under SFDR – Article 8. Our work at Polaris Management level and for each strategy is further detailed in our publicly available Responsible Investment Policy (RIP).

Sustainability standards

To create a solid foundation for our work with sustainability, our Sustainability Strategy is based on, and aligned with, recognized international standards and regulations. With this approach we seek to ensure that we cover both financial and impact materiality, in a consistent and reliabile way in our reporting and that we support strengthened reporting practices and the development of common standards in the investment community with respect to sustainability.

Polaris’ sustainability focus areas

Polaris has identified three areas within sustainability that form the main pillars of our sustainability focus. For each focus area we have formulated a cross-portfolio KPI that we work to apply across all investment strategies and portfolio companies. In the private equity strategy, the KPIs are reported on both at fund level, individually at portfolio company level and for Polaris Management. In our work as active owners, we at Polaris Management will make an extra effort to improve and make a difference in these three areas:

Climate change is one of the biggest challenges of our time and requires the attention of today’s investment community. It might mean significant risks, costs and investments for companies and investors, but also significant opportunities for companies addressing this challenge.

We must all acknowledge that organizations around the world need to significantly step up their climate focus, in order for us all to meet the commitments made under the Paris Agreement and any policy responses that are under way to close the gap. The investment community has an important role to play in supporting the green transition and thereby also a responsibility to act.

In Polaris, we take our responsibility seriously and acknowledge that through our investments we have a considerable carbon footprint. We have therefore chosen to make Climate Action, with main focus on CO2e emissions, a key element in our sustainability work. Our objective is to support our portfolio companies to fulfill their part of the Paris Agreement by setting their own Science Based Targets and reduce their emissions accordingly.

Sustainability in our investment process

Our investment process has been developed to support our commitment to sustainability and our Sustainability Strategy and is aligned with the international standards. Our investment process is described in our publicly available Responsible Investment Policy (RIP).

The investment process

Polaris Sustainability Program

'Polaris Sustainability Program‘ includes a set of fundamental actions and deliverables that constitute the sustainability structure that we believe is suitable for the medium-sized Nordic companies in which we invest. The components of ‘Polaris Sustainability Program’ are also integrated and aligned with our investment strategy and sustainability due diligence. While the program is based on Polaris Sustainability Principles and internationally recognized standards and best practices within sustainability, it is structured to be customized to the specific risks and opportunities of the specific company, the specific industry and the company's level of maturity. It is mandatory in our private equity investment strategy where we have majority control. It is consequently extensively tested and continously developed. The program process is supported by onboarding sessions during which both Board of Directors and management teams of a new portfolio company will be introduced to Polaris’ sustainability work and sustainability strategy. The work builds upon established frameworks and practices and is supported by specialist consultants that support the portfolio companies as they embark on the journey and help build sustainability competencies in the portfolio companies.

Polaris is subject to a number of regulations and industry practises.

Polaris Management A/S and the funds managed by us in our different investment strategies are subject to a number of regulations and industry practises. We work continuously to monitor and adapt to these to ensure compliance and we engage with external experts to support us in this effort. We also aim to set a good example and promote the development of standards and industry practises within sustainability in our industry.