Mandatory disclosures – PPE V Co-invest

Web disclosure for the financial products referred to in Article 8, paragraphs 1, 2 and 2a, of Regulation (EU) 2019/2088 and Article 6, first paragraph, of Regulation (EU) 2020/852.

Product name:

Polaris V F&F Co-invest K/S (“PPE V Co-invest” or “The Fund”)

Legal Entity Identifier (LEI):

549300STRKTKMHIW6W10

1. Summary

The strategy of The Fund is to invest in mid-sized companies based in the Nordic region. The objective is to invest in good companies with great potential and make them better in partnership with the management team and board. The Fund does not have sustainable investment as its objective but promotes the following environmental and social characteristics as part of its investment strategy. Prior to each investment in a portfolio company of The Fund, Polaris conducts an extensive due diligence including an in-depth review of risks and opportunities related to sustainability and The Funds environmental and social characteristics:

- Minimum requirements for eligible investment (exclusion criteria) – We ensure that we do not invest in unsustainable sectors (gambling, weapons, tobacco, alcohol, and pornography) or in companies with an unacceptable exposure to countries, persons or entities on the UN Sanctions list. We also ensure that the companies that we acquire do not have an unacceptable risk for, or actual, adverse sustainability impacts. We also establish that it seems reasonable and probable that we will be able to improve the company’s sustainability performance during our ownership. We follow-up to ensure that all of the investment (100%) made by The Fund fulfill these critera.

- Management of adverse sustainability impacts: We ensure that our portfolio companies have, or implement during our ownership, a management system for the prevention, mitigation and management of adverse sustainability impacts as defined by the UN Guiding Principles and OECD Guidelines for Multinational Enterprises for Responsible Business Conduct. We follow-up to ensure that all of our investments (100%) implement this management system.

- Promotion of climate change mitigation: We work with our portfolio companies to reduce their climate impact and measure and reduce their greenhouse gas emissions. We target annual reductions and encourage portfolio companies to support the Paris Agreement and set ‘science based’ CO2 emissions reduction reduction targets as defined by the Science Based Target Initiative. We follow-up on all companies CO2 emissions annually.

- Promotion of gender equality: We work with our portfolio companies to improve their gender equality. We follow-up on our portfolio companies gender distribution on management teams and boards and target at least 40% of each gender. We follow-up on all companies gender distribution annually.

- Promotion of improved working environment: We work with our portfolio companies to improve the working environment in our portfolio companies and measure and track their employee initiated employee turnover where we target a stable development at a low level as suitable for the company. We follow-up on all companies employee-initiated employee turnover annually.

The board of directors of each portfolio company is responsible for ensuring that all indicators are measured, their development analysed and the appropriate actions are taken. The Polaris representative in the board of directors is the responsible in the board for sustainability and ensures measurement and follow-up is performed together with the chairman.

Polaris will follow-up annually how each portfolio company and The Fund perform in relation to the specific targets for each specific indicator. If the performance of an invididual portfolio company and The Fund is (i) improving and/or (ii) reaches the targets for each indicator, Polaris would conclude that we are successfully promoting our social and environmental characteristics. The companies provide the data on a ‘best effort’ basis and it is not required to be audited or reviewed. Polaris strive to provide actual bottom-up data from each portfolio company. In the case a portfolio company has not been able to provide a specific indicator, the indicator will be estimated in an appropriate way. If data is not possible to attain, the ability to track improvements will be limited. We will however still be able to promote each of The Funds environmental and social characteristics through actions and initiatives to improve in each individual area.

100% of the investments in The Fund follow the same investment strategy including the environmental and social characteristics promoted as part of this strategy. No use of derivatives are planned for this product or part of the investment strategy and we have not designated a specific index as a reference benchmark.

The strategy of the Fund is to only invest directly in majority equity holdings in companies and not to make any indirect investments or investments in funds. Polaris, as a majority owner, is therefor able to engage directly through the ultimate control of the company through the board of directors. Polaris also represents The Fund directly, by assigning a Polaris employee as a member of the board. Polaris is also responsible for recruiting the chairman of the board and the other board members.

The integration of sustainability in our investment process and our governance structure is governed by our Responsible Investment Policy which is publicly available on our website.

Danish version/dansk version

Fondens strategi er at investere i mellemstore virksomheder i Norden med henblik på at investere i stærke selskaber med et stort potentiale, og styrke selskaberne yderligere gennem ejerskabsperioden i samarbejde med ledelsen og bestyrelsen. Det er ikke fondens hovedformål at investere ud fra et bæredygtighedsperspektiv, men fonden promoverer og fokuserer på udvalgte miljømæssige og sociale forhold som en del af investeringsstrategien. Forud for en investering i et potentielt porteføljeselskab udarbejder Polaris en detaljeret due diligence analyse af selskabets risici og muligheder i forhold til de bestemte miljømæssige og sociale forhold, som er blandt fondens fokusområder inden for bæredygtighed:

- Minimum standarder og krav til en investering (eksklusionskriterier): Vi garanterer, at vi ikke investerer i sektorer, som ikke er bæredygtige (gambling, våben, tobak, alkohol og pornografi) eller selskaber med en uacceptabel eksponering til lande, personer eller enheder på UNs sanktionsliste. Vi garanterer desuden, at vi ikke investerer i selskaber, der har en for høj negativ indvirkning på miljøet eller har høj risiko for at få det i fremtiden. Derudover investerer vi ud fra en forventning om, at vi kan styrke selskabernes performance og profillering inden for bæredygtighed gennem vores ejerskabsperiode. Vi følger løbende op for at sikre, at alle vores porteføljeselskaber i fonden lever op til disse kriterier.

- Håndtering af negative påvirkninger: Vi garanterer, at vores porteføljeselskaber har – eller implementerer - en struktur til at mitigere, modvirke og håndtere negative miljømæssige og sociale påvirkninger, som er defineret af ’UN Guiding Principles’ og ’OECD Guidelines’ for ’Multinational Enterprises for Responsible Business Conduct’. Vi følger løbende op for at sikre, at alle vores porteføljeselskaber implementerer den nødvendige struktur.

- Promovering af initiativer til at reducere klimaforandringerne: Vi arbejder med vores porteføljeselskaber mod at reducere deres negative indflydelse på klimaet og reducere deres drivhusgasudledning. Vi sætter mål for deres årlige udledning og opfordrer porteføljeselskaberne til at supportere Parisaftalen og sætte ’Science Based Targets’ til at reducere deres drivhusgasemissioner efter ’Science Based Targets Initiative’. Vi følger op på porteføljeselskabernes drivhusgasudledninger årligt.

- Fremme af kønsdiversitet: Vi supporterer vores porteføljeselskaber i deres arbejde med at opnå en større kønsdiversitet i deres ledelser og bestyrelser. Vi måler fordelingen af mænd og kvinder blandt porteføljeselskabernes ledelses- og bestyrelsesmedlemmer med henblik på at nå vores målsætning om, at der på sigt vil være minimum 40% mænd og kvinder i ledelserne og bestyrelserne.

- Forbedring af arbejdsmiljøet: Vi arbejder med vores porteføljeselskaber mod at forbedre deres arbejsmiljø og løbende følge og måle medarbejderomsætningsniveauet, ’Employee-initiated employee turnover’, der er et udtryk for selskaberne tab og tilgange af medarbejdere og hvorvidt det er initieret af medarbejderen eller ej, hvor vi stræber efter en stabil udvikling på et lavt antal medarbejdere i forhold til det enkelte selskabs profil og behov. Vi følger op på medarbejderomsætningen i alle porteføljeselskaber på årlig basis.

Hvert porteføljeselskabs bestyrelse er ansvarlig for at sikre, at alle ovenstående fokusområder bliver målt, udviklingen følges og analyseres, og at der gennemføres de rette tiltag til at optimere udviklingen. Bestyrelsesmedlemmet fra Polaris er den ansvarlige for bæredygtighedsagendaen og for at sikre at opfølgning og måling bliver udarbejdet i samarbejde med bestyrelsesformanden.

Polaris vil årligt følge op på alle porteføljeselskabers og fondens samlede performance i forhold til de enkelte bæredygtighedsparametre. Hvis det enkelte selskab forbedrer sin performance og fonden samlet set (i) forbedrer og/eller (ii) når de specifikke mål sat for hver parametre, vil vi overordnet set vurdere, at Polaris promoverer sine miljømæssige og sociale målsætninger på et tilfredsstillende niveau. Porteføljeselskaberne gør deres bedste for at levere data af højest mulig kvalitet, og det er ikke påkrævet at data bliver revideret af en ekstern part. Polaris bestræber sig på at levere bottom-up data fra hvert porteføljeselskab, men i tilfælde af et porteføljeselskab ikke er i stand til at levere et specifikt datapunkt, vil datapunktet i stedet blive estimeret. Hvis det ikke er muligt at fremskaffe optimale datapunkter af den ønskede kvalitet, vil muligheden for at følge forbedringer også være begrænset. Vi vil til gengæld stadig have mulighed for at promovere fondens miljømæssige og sociale karakteristika på baggrund af de tiltag og initiativer, der gennemføres inden for hvert fokusområde.

100% af alle investeringer foretaget af fonden følger samme investeringsstrategi, hvilket også inkluderer de miljømæssige og sociale formål som promovores i investeringsstrategien. Derivater er ikke en del af investeringsstrategien og fonden har ikke et specifikt benchmark index.

Fondens strategi er majoritetsinvesteringer i selskaber, og ikke indirekte investeringer eller investeringer i andre fonde. Som majoritetsejer har Polaris derfor direkte indflydelse på udviklingen i et porteføljeselskab gennem bestyrelsen. Fonden er også direkte repræsenteret i hvert porteføljeselskab ved, at en Polaris Partner tager en bestyrelsespost i porteføljeselskaberne. Polaris er desuden ansvarlig for at rekruttere bestyrelsesformanden og andre bestyrelsesmedlemmer.

Integrationen af bæredygtighed i Polaris’ investeringsprocessen og governancestruktur bliver fulgt gennem Polaris ’Responsible Investment Policy’, som er offentlig tilgængelig på vores hjemmeside.

2. No sustainable investment objective

This financial product promotes environmental or social characteristics but does not have as its objective sustainable investment.

3. Environmental or social characteristics of the financial product

Polaris Management A/S (“Polaris”) is the fund manager of Polaris V F&F Co-invest K/S (“PPE V Co-invest” or “The Fund”) which is a co-investment vehicle for investing alongside Polaris Private Equity V K/S ("PPE V"). Polaris promotes both environmental and social characteristics generally as a fund manager, for PPE V and for this financial product. The following environmental & social characteristics are promoted as part of the investment strategy in PPE V and then also PPE V Co-invest:

- Exclusion criteria - No support to unsustainable sectors: Polaris ensures that we do not make investments in portfolio companies that are part of, or have an important exposure to, the following sectors: gambling, weapons, tobacco, alcohol, and pornography.

- Exclusion criteria - No support to sanctioned countries, persons or entities: Polaris ensures that we do not make investments in portfolio companies companies with an un-acceptable exposure to countries, persons or entities on the UN Sanctions list.

- Exclusion criteria - Reasonable risk: By assessing sustainability-related risks, hereunder principal adverse impacts, in potential investments, we ensure that we do not invest in companies with an unacceptable risks for adverse sustainability impacts, or with unacceptable actual adverse sustainability impacts.

- Ability to improve: For the investments that pass our selection criteria, we establish that it seems reasonable and probable that we will be able to improve the company’s sustainability performance, through decreasing their risk of adverse sustainability impacts and reducing their actuial adverse sustainability impacts during our ownership.

- Management of adverse sustainability impacts: Ensure prevention, mitigation and management of adverse sustainability impacts as defined by the UN Guiding Principles and OECD Guidelines for Multinational Enterprises by implementation of a management system for responsible business conduct as defined by these frameworks.

- Promotion of climate change mitigation: We work with our portfolio companies to measure and reduce their greenhouse gas emissions.

- Promotion of gender equality: We work with our portfolio companies to improve their gender equality.

- Promotion of improved working environment: We work with our portfolio companies to improve the working environment in our portfolio companies.

4. Investment strategy

The investment strategy of The Fund is to invest in mid-sized companied based in the Nordic region. The Fund aims to invest in good companies with great potential and make them better in partnership with the management and board. The investment strategy is agreed with the investors in The Fund. Polaris is contracted by The Fund to source investments and manage the portfolio companies in-line with the agreed investment strategy. Sustainability is integrated across this investment strategy, from deal sourcing and due diligence to portfolio management and exit. The board of The Fund approves all investments that Polaris propose to be made by The Fund and ensures adherence to the investment strategy including the agreed sustainability related exclusion criteria. Polaris ensures that sustainability related risks and opportunities are analyzed and fully integrated in the overall evaluation of each new investments. In the portfolio management phase, Polaris then work with each portfolio company to ensure that they develop their sustainability work in-line with Polaris’ standards and improve their performance. This includes the management of sustainability risks, hereunder principle adverse impacts.

We evaluate the governance processes of potential acquisitions and evaluate if the company has established governance principles in-line with the UN/OECD principles for responsible business conduct. If these do not exist, we evaluate whether we believe that these can be established by the management team, with support of Polaris and our advisors, following an acquisition. If either case is true, we are willing to proceed with the acquisition.

Once a company is acquired by a Polaris fund, we will ensure the establishment of a structured governance process lead by a board of directors appointed by Polaris.

The integration of sustainability in our investment process and our governance structure is governed by our Responsible Investment Policy which is publicly available on our website.

5. Proportion of investments

100% of the investments in The Fund follow the same investment strategy including the environmental and social characteristics promoted as part of this strategy. No use of derivatives are planned for this product or part of the investment strategy. The strategy of the Fund is to only invest directly in majority equity holdings in companies and not to make any indirect investments, investments in funds.

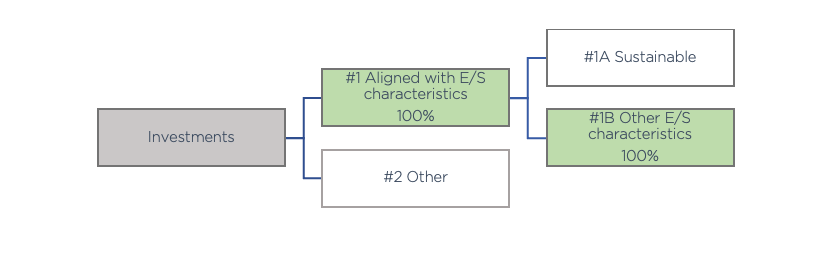

The investment strategy make all investments made by The Fund fall under the SFDR sub-category ‘#1B Other E/S caracteristics’ as depticed below.

The sub-category #1B Other E/S characteristics covers investments aligned with the environmental or social characteristics that do not qualify as sustainable investments as defined by the EU Taxonomy and SFDR Art. 2(17).

6. Monitoring of environmental or social characteristics

As part of our investment strategy, we will determine the specific and unique risks and opportunities related to sustainability for each individual investment and then identify suitable indicators to monitor the performance of the most relevant areas for the investment. As part of the monitoring of the development of the company’s performance on environmental and social characteristics, we will also monitor the following indicators for all our investments:

- Exclusion criteria - No support to unsustainable sectors: We measure the number of investments made in-line with our investment criteria and target 100%.

- Exclusion criteria - No support to sanctioned countries, persons or entities: We measure the number of investments made in-line with our investment criteria and target 100%.

- Exclusion criteria - Reasonable risk: We measure the number of investments made in-line with our investment criteria and target 100%.

- Ability to improve: We measure the number of investments made in-line with our investment criteria and target 100%.

- Management of adverse sustainability impacts: We aim to implement a management system in-line with UN Guiding Principles and OECD guidelines for Multinational Enterprises within 12 months following acquisition and sign-up to the UN Global Compact. We follow-up on the implementation rate among our portfolio companies and target 100% adherence for the companies acquired more than 12 months earlier.

- Promotion of climate change mitigation: We measure the Greenhouse Gas Emissions of each portfolio company according to the GHG Protocoll and aim to reduce each company’s absolute GHG emissions (tonnes of CO2 equivalent) and/or each company’s GHG intensity (tonnes of CO2 equivalent in relation to turnover or other relevant measure of company output). We target annual reductions and encourage portfolio companies to support the Paris Agreement and set ‘science based’ CO2 emissions reduction reduction targets as defined by the Science Based Target Initiative.

- Promotion of gender equality: We work measure the gender distribution at the board of director level and management team level and target a distribution of at least 40% of each gender.

- Promotion of improved working environment: We measure employee initiatied employee turnover and target an annual reduction or a stable development at a low level as suitable for each individual portfolio company.

The board of directors of each portfolio company is responsible for ensuring that these indicators are measured, their development analysed and the appropriate actions are taken. The Polaris representative in the board of directors is the responsible in the board for sustainability and ensures measurement and follow-up is performed together with the chairman.

In the ownership phase, Polaris also gathers the data on the indicators above and their development for each portfolio company. In addition, Polaris also monitors the progress of the mandatory Principle Adverse Impacts (PAIs) as defined in the EU regulations (the Sustainable Finance Disclosure Regulation, SFDR, (EU) 2019/2088, Annex I, Table 1) that are not part of Polaris standard indicators. This data is used in the process to develop and follow-up on the sustainability efforts, and improvements, of each indiviudual portfolio company. In addition, Polaris monitors the development of the indicators and PAIs at an aggregate level for The Fund to understand the overall adverse impacts of the overall portfolio. Information on the PAI on sustainability factors for The Fund will be communicated to investors.

7. Methodologies for environmental or social characteristics

Polaris will follow-up annually how each portfolio company and The Fund perform in relation to the specific targets for each specific indicator. . If the performance of an invididual portfolio company and The Fund is (i) improving and/or (ii) reaches the targets for each indicator, Polaris would conclude that we are successfully promoting our social and environmental characteristics. Our targets are fulfilled either at the time of acquisition or fulfilled during the ownership period. Those that are fulfilled during our ownership period might have general targets which are the same for all portfolio companies or targets which are company specific. Targets fulfilled at the time of acquisition.

The attainment of the targets for these indicators is secured in the investment process and can be verified at the time of acquisition to reach the target of 100%:

- Exclusion criteria - No support to unsustainable sectors: We measure the number of investments made in-line with our investment criteria and target 100%.

- Exclusion criteria - No support to sanctioned countries, persons or entities: We measure the number of investments made in-line with our investment criteria and target 100%.

- Exclusion criteria - Reasonable risk: We measure the number of investments made in-line with our investment criteria and target 100%.

- Ability to improve: We measure the number of investments made in-line with our investment criteria and target 100%.

Targets fulfilled during out ownership

The following targets are measured and followed-up at least annually during our ownership period.

- Management of adverse sustainability impacts: We aim to implement a management system in-line with UN Guiding Principles and OECD guidelines for Multinational Enterprises within 12 months following acquisition and sign-up to the UN Global Compact. We follow-up on the implementation rate among our portfolio companies and target 100% adherence for the companies acquired more than 12 months earlier. This is a general target which is the same for all portfolio companies.

- Promotion of climate change mitigation: We measure the Greenhouse Gas Emissions of each portfolio company according to the GHG Protocoll and aim to reduce each company’s absolute GHG emissions (tonnes of CO2 equivalent) and/or each company’s GHG intensity (tonnes of CO2 equivalent in relation to turnover or other relevant measure of company output). We target annual reductions and encourage portfolio companies to support the Paris Agreement and set ‘science based’ CO2 emissions reduction reduction targets as defined by the Science Based Target Initiative. The target for this indicator will therefor be unique and specific for each individual portfolio company.

- Promotion of improved working environment: We measure employee initiatied employee turnover and target an annual reduction or a stable development at a low level as suitable for each individual portfolio company. The target for this indicator will therefor be unique and specific for each individual portfolio company.

- Promotion of gender equality: We work measure the gender distribution at the board of director level and management team level and target a distribution of at least 40% of each gender. This is a general target which is the same for all portfolio companies.

8. Data sources and processing

The data for each indicator is requested from each individual portfolio company by Polaris on an annual basis and consolidated by Polaris. The companies provide the data on a ‘best effort’ basis and it is not required to be audited or reviewed. Polaris strive to provide actual bottom-up data for each from each portfolio company. In the case a portfolio company has not been able to provide a specific indicator, the indicator will be estimated in an appropriate way. This might be done through benchmark data from other Polaris portfolio companies, other external companies, industry averages or estimated in other ways. For example with the help of industry experts, third party data providers or desktop research. Estimated indicators must be expected to have a larger associated margin of error. Polaris will therefor strive to get actual bottom-up data for each indicator from each portfolio company. This is also what most effectively will support the management of related adverse impacts. We have no thresholds for the acceptable margin of error in the data or the extent to which data has been estimated. The indicator most likely to be missing, and need to be estimated, is a portfolio company GHG emissions, especially on Scope 3.

9. Limitations to methodologies and data

The data needed to track the attainment of our environmental and social characteristics are generally readily available to get from each portfolio company. The indicators that require most resources to get is data on CO2e emissions and to some extent Employee-initiated Employee Turnover. Polaris will work to support that each portfolio invest the necessary time and resources to set up the measurement of these data points. In certain cases, it might however not be possible to complete in a given year due to conflicting priorities and resource constraints. If data is not possible attain, the ability to track improvements will be limited. We will however still be able to promote each of The Funds environmental and social characteristics through actions and initiatives to improve in each individual area.

10. Due diligence

Prior to each investment in a portfolio company of The Fund, Polaris’ conduct a extensive due diligence including an in-depth review of risks and opportunities related to sustainability and The Funds environmental and social characteristics. The sustainability due diligence is performed by Polaris and supported by external experts as needed and the results are fully integrated into the overall assessment of each potential investment. Each investment, including the sustainability due diligence, is approved by Polaris internal investment committee for The Fund, the board of directors in Polaris Management A/S and the board of The Fund.

11. Engagement policies

The Fund will make investments where Polaris attain a majority control of each of its portfolio companies. Polaris, as a majority owner, is therefor able to engage directly through the ultimate control of the company through the board of directors. Polaris also represents The Fund directly, by assigning a Polaris employee as a member of the board. Polaris is also responsible for recruiting the chairman of the board and the other board members.

12. Designated reference benchmark

We have not designated a specific index as a reference benchmark.