Mandatory disclosures – PFC I

Web disclosure for the financial products referred to in Article 8, paragraphs 1, 2 and 2a, of Regulation (EU) 2019/2088 and Article 6, first paragraph, of Regulation (EU) 2020/852.

Product name:

Polaris Flexible Capital I (“PFC I” or “The Fund”)

Legal Entity Identifier (LEI):

549300AGQ31XV48FLE75

1. Summary

The investment strategy of The Fund is to invest in mid-sized companied primarily based in the Nordic region, with the opportunity to selectively pursue opportunities outside this region. The Fund will be providing capital for growth, succession, transformations, and consolidations to attractive companies across different tranches of the capital structure. Operating within a flexible investment mandate, The Fund will tailor capital solutions to best fit the needs of the companies it will be partnering with, thereby supporting companies and owners. The Fund will be investing capital through-out the capital structure from i) junior loans, including uni-tranche, and second lien to ii) preferred equity and common minority equity. In addition hereto, the fund has the opportunity to invest up to 20% of the fund in listed credit bonds. The Fund does not have sustainable investment as its objective but promotes the following environmental and social characteristics as part of its investment strategy. Prior to each investment in a portfolio company of The Fund, Polaris’ conducts a due diligence including a review of risks and opportunities related to sustainability and The Funds environmental and social characteristics. The following of these characteristics will be possible to be directly influenced by the Fund:

- Minimum requirements for eligible investment (exclusion criteria) – We ensure that we do not invest in unsustainable sectors (gambling, weapons, tobacco, alcohol, and pornography) or in companies with an unacceptable exposure to countries, persons or entities on the UN Sanctions list. We also ensure that the companies that we acquire do not have an unacceptable risk for, or actual, adverse sustainability impacts and that the company has a governance structure deemed adequate to manage sustainability. In addition, we also secure that the board in each portfolio company commit to discussing sustainability at least annually and that they agree to report on their progress to Polaris at least annually. We follow-up to ensure that all of the investments (100%) made by The Fund fulfill these critera.

The Fund will also seek to measure and influence the following sustainability indicators but might have limited, or very limited, ability to infuence their measurement, target setting, development and related actions:

- Management of adverse sustainability impacts: If it is not in place already, we seek to influence and encourage our portfolio companies to implement a management system for the prevention, mitigation and management of adverse sustainability impacts as defined by the UN Guiding Principles and OECD Guidelines for Multinational Enterprises for Responsible Business Conduct. We follow-up and we target that all investments (100%) implement this management system.

- Promotion of climate change mitigation: We will seek to influence our portfolio companies to reduce their climate impact and measure and reduce their greenhouse gas emissions. We target annual reductions and encourage portfolio companies to support the Paris Agreement and set ‘science based’ CO2 emissions reduction reduction targets as defined by the Science Based Target Initiative. We will follow-up on all companies CO2 emissions annually.

- Promotion of gender equality: We will seek to influence our portfolio companies to improve their gender equality , follow-up on their gender distribution on management teams and boards and target at least 40% of each gender. We will follow-up on our companies gender distribution annually.

- Promotion of improved working environment: We will seek to influence our portfolio companies to improve the working environment , measure and track their employee initiated employee turnover and target a stable development at a low level as suitable for the company. We will follow-up on all companies employee-initiated employee turnover annually.

Polaris will use the influence at our disposal in each portfolio company to promote, encourage and support that the board of directors of each portfolio company ensures that these indicators are measured, their development analysed and the appropriate actions are taken. A senior member from Polaris investment team working with the Fund will be responsible for the engagement with each individual portfolio company.

Polaris will follow-up annually how each portfolio company and The Fund perform in relation to the specific targets for each specific indicator. If the performance of an invididual portfolio company and The Fund is (i) improving and/or (ii) reaches the targets for each indicator, Polaris would conclude that we are successfully promoting our social and environmental characteristics. The companies provide the data on a ‘best effort’ basis and it is not required to be audited or reviewed. Polaris strive to provide actual bottom-up data from each portfolio company. In the case a portfolio company has not been able to provide a specific indicator, the indicator will be estimated in an appropriate way. If data is not possible to attain, the ability to track improvements will be limited. We will however still be able to promote each of The Funds environmental and social characteristics through actions and initiatives to improve in each individual area.

100% of the investments in The Fund follow the same investment strategy including the environmental and social characteristics promoted as part of this strategy. No use of derivatives are planned for this product or part of the investment strategy and we have not designated a specific index as a reference benchmark.

The strategy of the Fund is to only invest directly in equity and debt holdings in companies and not to make any indirect investments or investments in funds. The Fund will not make investments where Polaris attain a majority control of its portfolio companies and will therefor have more limited opportunities for influence and control. The Fund will invest across a range of investment structures which have varying governance rights, and the approach to participation in the value creation process will reflect this. However, the ambition is that The Funds contribution to the development of its portfolio companies should be driven by cooperation between the respective company’s Board of Directors (“board”), owners, management, lenders and other key stakeholders. A senior member from Polaris investment team working with the Fund will be responsible for the engagement with each individual portfolio company.

The integration of sustainability in our investment process and our governance structure is governed by our Responsible Investment Policy which is publicly available on our website.

Danish version/dansk version

Fondens strategi er at investere i mellemstore virksomheder i Norden, men med mulighed for at udvide porteføljen med virksomheder uden for Norden. Fonden vil bidrage med kapital til at realisere vækstambitioner, successioner, transformationer eller udnytte konsolideringsmuligheder i attraktive selskaber på tværs af trancher i kapitalstrukturen. Fonden har et fleksibelt investeringsmandat og kan skræddersy kapitalløsninger tilpasset det enkelte selskab baseret på de eksisterende ejeres ønsker og behov. Fonden vil investere på tværs af kapitalstrukturen og anvende i) junior lån, heriblandt uni-tranche, samt ii) præferenceaktier og minoritetsinvesteringer. Derudover har fonden også mulighed for at investere op til 20% af fonden i noterede obligationer. Det er ikke fondens hovedfokus at investere ud fra et bæredygtighedsperspektiv, men fonden promoverer og fokuserer på udvalgte miljømæssige og sociale forhold som en del af investeringsstrategien. Forud for en investering i et potentielt porteføljeselskab udarbejder Polaris en due diligence analyse af selskabets risici og muligheder i forhold til de bestemte miljømæssige og sociale forhold, som er blandt fondens fokusområder inden for bæredygtighed. De følgende områder kan fonden potentielt direkte influere gennem ejerskabsperioden:

- Minimum standarder og krav til en investering (eksklusionskriterier): Vi garanterer, at vi ikke investerer i sektorer, som ikke er bæredygtige (gambling, våben, tobak, alkohol og pornografi) eller selskaber med en uacceptabel eksponering til lande, personer eller enheder på UNs sanktionsliste. Vi garanterer desuden, at vi ikke investerer i selskaber, der har en for høj negativ indvirkning på miljøet eller har høj risiko for at få det i fremtiden. Derudover skal et porteføljeselskab have en governance struktur, der varetager bæredygtighed til et tilstrækkeligt niveau. Vi sikrer os, at bestyrelsen har bæredygtighed på agendaen minimum en gang om året, og selskabet skal rapportere deres udvikling til Polaris på årlig basis som minimum. Vi følger løbende op for at sikre, at alle fondens porteføljeselskaber opfylder de kriterier.

Fonden vil også forsøge at måle og influere de følgende bæredygtighedsområder, men kan muligvis have begrænset, eller meget begrænset, mulighed for at influere selskabets målinger, målsætninger, udvikling og relaterede initiativer og handlinger på de forskellige områder:

- Håndtering af negative påvirkninger: Vi stræber efter at influere og opfordre vores porteføljeselskaber til at implementere en struktur, der arbejder mod at mitigere, modvirke og håndtere negative miljømæssige og sociale påvirkninger, som er defineret af ’UN Guiding Principles’ og ’OECD Guidelines’ for ’Multinational Enterprises for Responsible Business Conduct’, hvis der ikke allerede eksisterer en lignende struktur i selskabet. Vi følger løbende op med selskaberne og stræber efter at alle porteføljeselskaber implementerer den nødvendige struktur.

- Promovering af initiativer til at reducere klimaforandringerne: Vi vil forsøge at influere vores porteføljeselskaber til at gennemføre initiativer til at reducere deres negative indflydelse på klimaet og reducere deres drivhusgasudledning. Vi vil opfordre porteføljeselskaberne til at sætte mål for deres årlige udledning, samt opfordre dem til at supportere Parisaftalen og sætte ’Science Based Targets’ til at reducere deres drivhusgasemissioner efter ’Science Based Targets Initiative’. Vi vil følge op på porteføljeselskabernes drivhusudledninger årligt.

- Fremme af kønsdiversitet: Vi vil opfordre vores porteføljeselskaber til at arbejde med at opnå en større kønsdiversitet, og vi vil følge op på udviklingen i fordelingen af mænd og kvinder blandt porteføljeselskabernes ledelses- og bestyrelsesmedlemmer og opfordre dem til at arbejde efter at opnå en fordeling med minimum 40% mænd og kvinder i ledelserne og bestyrelserne på sigt. Vi vil årligt følge op på kønsdiversiteten i porteføljeselskaberne.

- Forbedring af arbejdsmiljøet: Vi vil forsøge at influere selskabernes og deres arbejde med at optimere arbejdsmiljøet, og løbende følge og måle medarbejderomsætningsniveauet, hvor vi vil stræbe efter at porteføljeselskaberne har en stabil udvikling på et lavt antal medarbejdere i forhold til det enkelte selskabs profil og behov. Vi følger op på medarbejderomsætningsudviklingen årligt.

Polaris vil bruge sin indflydelse i hvert porteføljeselskab til at promovere, supportere og opfordre til at bestyrelsen i hvert porteføljeselskab sikrer, at ovenstående parametre bliver målt, udviklingen analyseres og der efterfølgende tages de nødvendige initiativer til at optimere på området. Et seniormedlem fra fondens investeringsteam vil være ansvarlig for at følge udviklingen og influere det enkelte porteføljeselskab.

Polaris vil årligt følge op på alle porteføljeselskabers og fondens samlede performance i forhold til de enkelte bæredygtighedsparametre. Hvis det enkelte selskab forbedrer sin performance og fonden samlet set (i) forbedrer og/eller (ii) når de specifikke mål sat for hver parametre, vil vi overordnet set vurdere, at Polaris promoverer sine miljømæssige og sociale målsætninger på et tilfredsstillende niveau. Porteføljeselskaberne gør deres bedste for at levere data af højest mulig kvalitet, og det er ikke påkrævet at data bliver revideret af en ekstern part. Polaris bestræber sig på at levere bottom-up data fra hvert porteføljeselskab, men i tilfælde af et porteføljeselskab ikke er i stand til at levere et specifikt datapunkt, vil datapunktet i stedet blive estimeret. Hvis det ikke er muligt at fremskaffe optimale datapunkter af den ønskede kvalitet, vil muligheden for at følge forbedringer også være begrænset. Vi vil til gengæld stadig have mulighed for at promovere fondens miljømæssige og sociale karakteristika på baggrund af de tiltag og initiativer, der gennemføres inden for hvert fokusområde.

100% af alle investeringer foretaget af fonden følger samme investeringsstrategi, hvilket også inkluderer de miljømæssige og sociale formål som promovores i investeringsstrategien. Derivater er ikke en del af investeringsstrategien og fonden har ikke et specifikt benchmark index.

Fondens strategi er at udbyde lånekapital eller investere i minoritetsposter i selskaber, og fonden vil ikke foretage indirekte investeringer eller investere i fonde. Fonden vil ikke foretage majoritetsinvesteringer og derfor vil Polaris have begrænset indflydelse og kontrol. Fonden vil investere over en bredere række af investeringsstrukturer med forskellige governance rettigheder, og derfor vil Polaris tilgang til værdiskabelsen i det enkelte selskab afhænge af det. Det er til gengæld ambitionen, at fonden vil bidrage til udviklingen i porteføljeselskaberne i samarbejde med selskabernes respektive bestyrelser, ejere, ledelse, långivere og andre interessenter. Et seniormedlem fra Polaris investeringsteam, som arbejder direkte med et specifikt porteføljeselskab i fonden, vil være ansvarlig for samarbejdet med selskabet og fondens indflydelse på udviklingen i selskabet.

Integrationen af bæredygtighed i Polaris’ investeringsprocessen og governancestruktur bliver fulgt gennem Polaris ’Responsible Investment Policy’, som er offentlig tilgængelig på vores hjemmeside.

2. No sustainable investment objective

This financial product promotes environmental or social characteristics but does not have as its objective sustainable investment.

3. Environmental or social characteristics of the financial product

Polaris Management A/S (“Polaris”) is the fund manager of Polaris Flexible Capital I (“PFC I” or “The Fund”). Polaris promotes both environmental and social characteristics generally as a fund manager and for this financial product. The following environmental & social characteristics are promoted as part of the investment strategy in PFC I:

- Exclusion criteria - No support to unsustainable sectors: Polaris ensures that we do not make investments in portfolio companies that are part of, or have an important exposure to, the following sectors: gambling, weapons, tobacco, alcohol, and pornography.

- Exclusion criteria - No support to sanctioned countries, persons or entities: Polaris ensures that we do not make investments in portfolio companies companies with an un-acceptable exposure to countries, persons or entities on the UN Sanctions list.

- Exclusion criteria - Reasonable risk: By assessing sustainability-related risks, hereunder principal adverse impacts, in potential investments, we ensure that we do not invest in companies with an unacceptable risks for adverse sustainability impacts, or with unacceptable actual adverse sustainability impacts.

- Sustainability governance: We assess if the company’s governance structure is deemed adequate to manage sustainability and the company’s adverse impact.

- Sustainability process: The company is willing to commit to (i) discussion sustainability at least annually in its board of directors and (ii) report annually to The Fund on the status and work related to sustainability

- Management of adverse sustainability impacts: Promote prevention, mitigation and management of adverse sustainability impacts as defined by the UN Guiding Principles and OECD Guidelines for Multinational Enterprises by supporting the implementation of a management system for responsible business conduct as defined by these frameworks.

- Promotion of climate change mitigation: We will seek to influence our portfolio companies to measure and reduce their greenhouse gas emissions.

- Promotion of gender equality: We will seek to influence our portfolio companies to improve their gender equality.

- Promotion of improved working environment: We will seek to influence our portfolio companies to improve the working environment in our portfolio companies.

4. Investment strategy

The investment strategy of The Fund is to invest in mid-sized companied primarily based in the Nordic region, with the opportunity to selectively pursue opportunities outside this region. The Fund will be providing capital for growth, succession, transformations, and consolidations to attractive companies across different tranches of the capital structure. Operating within a flexible investment mandate, The Fund will tailor capital solutions to best fit the needs of the companies it will be partnering with, thereby supporting companies and owners. The Fund will be investing capital through-out the capital structure from i) junior loans, including uni-tranche, and second lien to ii) preferred equity and common minority equity. In addition hereto, the fund has the opportunity to invest up to 20% of the fund in listed credit bonds. Polaris is contracted by The Fund to source investments and manage the portfolio companies in-line with the agreed investment strategy. Sustainability is integrated across this investment strategy, from deal sourcing and due diligence to portfolio management and exit. The board of The Fund approves all investments that Polaris propose to be made by The Fund and ensures adherence to the investment strategy including the agreed sustainability related exclusion criteria. Polaris ensures that sustainability related risks and opportunities are analyzed and fully integrated in the overall evaluation of each new investments. In the portfolio management phase, Polaris then work with each portfolio company and try to influence them to develop their sustainability work in-line with Polaris’ standards and improve their performance. This includes the management of sustainability risks, hereunder principle adverse impacts.

We evaluate the governance processes of potential acquisitions and evaluate if the company has, or will have, a governance structure which is deemed adequate to manage sustainability and the company’s adverse impact. We will assess if the governance principles are in-line with the UN/OECD principles for responsible business conduct. If these do not exist, we evaluate whether these can be established by the management team, with support of Polaris and our advisors, following an acquisition.

The Fund wants to contribute to the value creating process at the companies it invests in and thereby help building stronger companies. The Fund will invest across a range of investment structures which have varying governance rights, and the approach to participation in the value creation process will reflect this. However, the ambition is that The Funds contribution to the development of its portfolio companies should be driven by cooperation between the respective company’s Board of Directors (“board”), owners, management, lenders and other key stakeholders. In its capacity as a stakeholder and investor in a portfolio company, The Fund will work to ensure that they contribute to a positive development of the company and to responsible management of sustainability related risks and opportunities, hereunder principal adverse impacts on sustainability factors.

The integration of sustainability in our investment process and our governance structure is governed by our Responsible Investment Policy which is publicly available on our website.

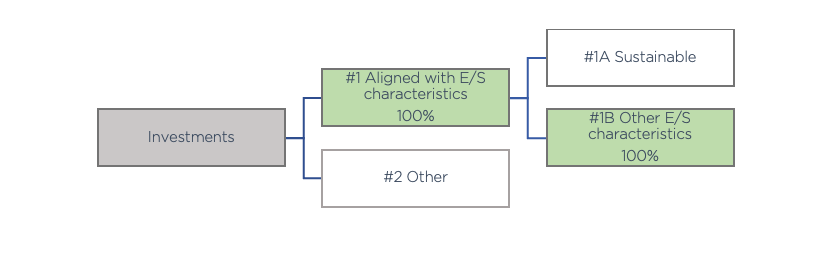

5. Proportion of investments

100% of the investments in The Fund follow the same investment strategy including the environmental and social characteristics promoted as part of this strategy. No use of derivatives are planned for this product or part of the investment strategy. The strategy of the Fund is to only invest directly in equity or debt instruments in companies and not to make any indirect investments or investments in funds.

The investment strategy make all investments made by The Fund fall under the SFDR sub-category ‘#1B Other E/S caracteristics’ as depticed below.

The sub-category #1B Other E/S characteristics covers investments aligned with the environmental or social characteristics that do not qualify as sustainable investments as defined by the EU Taxonomy and SFDR Art. 2(17).

6. Monitoring of environmental or social characteristics

To monitor the development of the environmental and social characteristics of the Fund we will follow-up on certain performance criteria. The Fund will be able to impact the performance on the following sustainability indicators:

- Exclusion criteria - No support to unsustainable sectors: We measure the number of investments made in-line with our investment criteria and target 100%.

- Exclusion criteria - No support to sanctioned countries, persons or entities: We measure the number of investments made in-line with our investment criteria and target 100%.

- Exclusion criteria - Reasonable risk: We measure the number of investments made in-line with our investment criteria and target 100%.

- Sustainability governance: We assess if the company’s governance structure is deemed adequate to manage sustainability and the company’s adverse impact. We target 100% compliance.

- Sustainability process: The company is willing to commit to (i) discussion sustainability at least annually in its board of directors and (ii) report annually to The Fund on the status and work related to sustainability. We target 100% compliance.

The Fund will also seek to measure and influence the following sustainability indicators but might have limited, or very limited, ability to infuence their measurement, target setting, development and related actions:

- Management of adverse sustainability impacts: We aim to influence our portfolio companies to implement a management system in-line with UN Guiding Principles and OECD guidelines for Multinational Enterprises and sign-up to the UN Global Compact. We follow-up on the implementation rate among our portfolio companies and target 100% adherence for the portfolio companies acquired more than 12 months earlier.

- Promotion of climate change mitigation: We encourage our portfolio companies to measure their Greenhouse Gas Emissions according to the GHG Protocoll and try to influence them to reduce each their absolute GHG emissions (tonnes of CO2 equivalent) and/or their GHG intensity (tonnes of CO2 equivalent in relation to turnover or other relevant measure of company output). We will support annual reductions and encourage portfolio companies to support the Paris Agreement and set ‘science based’ CO2 emissions reduction reduction targets as defined by the Science Based Target Initiative.

- Promotion of gender equality: We will encourage our portfolio companies to work to measure the gender distribution at the board of director level and management team level and target a distribution of at least 40% of each gender.

- Promotion of improved working environment: We will encourage our portfolio companies to measure employee initiatied employee turnover and to target an annual reduction or a stable development at a low level as suitable for each individual portfolio company.

Polaris will use the influence at our disposal in each portfolio company to promote, encourage and support that the board of directors of each portfolio company ensures that these indicators are measured, their development analysed and the appropriate actions are taken.

In the ownership phase, Polaris will attempt to gathers the data on the indicators above and their development for each portfolio company. In addition, Polaris also monitors the progress of the mandatory Principle Adverse Impacts (PAIs) as defined in the EU regulations (the Sustainable Finance Disclosure Regulation, SFDR, (EU) 2019/2088, Annex I, Table 1) that are not part of Polaris standard indicators. This data is used in the process to develop and follow-up on the sustainability efforts, and improvements, of each indiviudual portfolio company. In addition, Polaris monitors the development of the indicators and PAIs at an aggregate level for The Fund to understand the overall adverse impacts of the overall portfolio. Information on the PAI on sustainability factors for The Fund will be published in The Fund’s annual report.

7. Methodologies for environmental or social characteristics

Polaris will follow-up annually how each portfolio company and The Fund perform in relation to the specific targets for each specific indicator. . If the performance of an invididual portfolio company and The Fund is (i) improving and/or (ii) reaches the targets for each indicator, Polaris would conclude that we are successfully promoting our social and environmental characteristics. Our targets are fulfilled either at the time of acquisition or fulfilled during the ownership period. Those that are fulfilled during our ownership period might have general targets which are the same for all portfolio companies or targets which are company specific.

Targets fulfilled at the time of acquisition

The attainment of the targets for these indicators is secured in the investment process and can be verified at the time of acquisition to reach the target of 100%:

- Exclusion criteria - No support to unsustainable sectors: We measure the number of investments made in-line with our investment criteria and target 100%.

- Exclusion criteria - No support to sanctioned countries, persons or entities: We measure the number of investments made in-line with our investment criteria and target 100%.

- Exclusion criteria - Reasonable risk: We measure the number of investments made in-line with our investment criteria and target 100%.

- Sustainability governance: We assess if the company’s governance structure is deemed adequate to manage sustainability and the company’s adverse impact. We target 100% compliance.

- Sustainability process: The company is willing to commit to (i) discussion sustainability at least annually in its board of directors and (ii) report annually to The Fund on the status and work related to sustainability. We target 100% compliance.

Targets fulfilled during out ownership

The following targets are measured and followed-up at least annually during our ownership period. The Fund will seek to measure and influence these sustainability indicators but might have limited, or very limited, ability to infuence their measurement, target setting, development and related actions:

- Management of adverse sustainability impacts: We aim to influence our portfolio companies to implement a management system in-line with UN Guiding Principles and OECD guidelines for Multinational Enterprises and sign-up to the UN Global Compact. We follow-up on the implementation rate among our portfolio companies and target 100% adherence for the portfolio companies acquired more than 12 months earlier. This is a general target which is the same for all portfolio companies.

- Promotion of climate change mitigation: We encourage our portfolio companies to measure their Greenhouse Gas Emissions according to the GHG Protocoll and try to influence them to reduce each company’s absolute GHG emissions (tonnes of CO2 equivalent) and/or their GHG intensity (tonnes of CO2 equivalent in relation to turnover or other relevant measure of company output). We will support annual reductions and encourage portfolio companies to support the Paris Agreement and set ‘science based’ CO2 emissions reduction reduction targets as defined by the Science Based Target Initiative. The target for this indicator will therefor be unique and specific for each individual portfolio company.

- Promotion of gender equality: We will encourage our portfolio companies to measure the gender distribution at the board of director level and management team level and target a distribution of at least 40% of each gender. This is a general target which is the same for all portfolio companies.

- Promotion of improved working environment: We will encourage our portfolio companies to measure employee initiatied employee turnover and to target an annual reduction or a stable development at a low level as suitable for each individual portfolio company. The target for this indicator will therefor be unique and specific for each individual portfolio company.

8. Data sources and processing

The data for each indicator is requested from each individual portfolio company by Polaris on an annual basis and consolidated by Polaris. The companies provide the data on a ‘best effort’ basis and it is not required to be audited or reviewed. Polaris strive to provide actual bottom-up data for each from each portfolio company. In the case a portfolio company has not been able to provide a specific indicator, the indicator will be estimated in an appropriate way. This might be done through benchmark data from other Polaris portfolio companies, other external companies, industry averages or estimated in other ways. For example with the help of industry experts, third party data providers or desktop research. Estimated indicators must be expected to have a larger associated margin of error. Polaris will therefor strive to get actual bottom-up data for each indicator from each portfolio company. This is also what most effectively will support the management of related adverse impacts. We have no thresholds for the acceptable margin of error in the data or the extent to which data has been estimated. The indicator most likely to be missing, and need to be estimated, is a portfolio company GHG emissions, especially on Scope 3.

9. Limitations to methodologies and data

The data needed to track the attainment of our environmental and social characteristics are generally readily available to get from each portfolio company. The indicators that require most resources to get is data on CO2e emissions and to some extent Employee-initiated Employee Turnover. Given the influence at our disposal in each portfolio company, Polaris will work to support that each portfolio invest the necessary time and resources to set up the measurement of these data points. It might however not be possible to complete due to conflicting priorities, resource constraints or lack of support from the company. If data is not possible attain, the ability to track improvements will be limited. We will however still be able to promote each of The Funds environmental and social characteristics as possible given the influence at our disposal.

10. Due diligence

Prior to each investment in a portfolio company of The Fund, Polaris’ conducts a due diligence including a review of risks and opportunities related to sustainability and The Funds environmental and social characteristics. The sustainability due diligence is performed by Polaris and supported by external experts as needed and the results are fully integrated into the overall assessment of each potential investment. Each investment, including the sustainability due diligence, is approved by Polaris internal investment committee for The Fund, the board of directors in Polaris Management A/S and the board of The Fund.

11. Engagement policies

The Fund will not make investments where Polaris attain a majority control of its portfolio companies and will therefor have more limited opportunities for influence and control. The Fund will invest across a range of investment structures which have varying governance rights, and the approach to participation in the value creation process will reflect this. However, the ambition is that The Funds contribution to the development of its portfolio companies should be driven by cooperation between the respective company’s Board of Directors (“board”), owners, management, lenders and other key stakeholders. A senior member from Polaris investment team working with the Fund will be responsible for the engagement with each individual portfolio company.

12. Designated reference benchmark

We have not designated a specific index as a reference benchmark.