Compliance and regulatory

Polaris Management A/S and the funds managed by us are subject to a number of regulations and industry practices. Please find below an overview of these and our compliance.

Polaris is an Alternative Investment Fund Manager (AIFM)

Polaris Management A/S is licensed by The Danish Financial Supervisory Authority to operate as an Alternative Investment Fund Manager (AIFM) in accordance with the Danish Alternative Investment Fund Managers Act (Polaris FT number is 23009) and the Alternative Investment Fund Manager Directive Regulation (EU) 2011/61 (“the AIFMD”). Polaris has appointed Private Equity Administrators Depositary Service ApS as Depositary for the Polaris funds.

The funds managed by Polaris

Polaris Management A/S is currently the fund manager of three active funds under its private equity investment strategy (“PPE”). And one active fund, which is still fund raising, under the new flexible capital investment strategy (“PFC”):

- Funds managed under Polaris Private Equity strategy (“PPE”)

- Fund III: Polaris Private Equity III K/S launched in 2005. Commitment: EUR 365m. Status: Active

- Fund IV: Polaris Private Equity IV K/S launched in 2015. Commitment: EUR 448m. Status: Active

- Fund V: Polaris Private Equity V K/S launched in 2021. Commitment: EUR 650m. Status: Active

- Funds managed under Polaris Flexible Capital strategy (“PFC”)

- PFC I: Polaris Flexible Capital I K/S launched in 2022. Under fund raising. Status: Active

Polaris follows industry guidelines for members of the European Private Equity industry

As a European private equity investor, we at Polaris Management A/S want to engage in the development of the industry, including the promotion of sustainability, through the relevant industry associations. We are therefore an active member of the private equity associations, Invest Europe (previously named European Venture Capital Association, EVCA), Active Owners (previously named Danish Venture Capital Association, DVCA) and SVCA (Swedish Venture Capital Association). As a member of these industry associations, we also aim to comply with their guidelines including their codes of conduct and specific guidelines for valuation, disclosures and tax,

Signatory of Principles of Responsible Investment

As a member of the investment community, we are also a signatory of Principles for Responsible Investment (“PRI”) and follow their principles. These guidelines and principles are integrated in the way we work, impact the way we conduct our business, the public disclosures on our webpage, the annual reports of our portfolio companies and the set-up of our legal structure.

Signatories of UN Global Compact

Polaris Management A/S is a member of UN Global Compact and we work according to the underlying internationally agreed principles for sustainable development consisting of the UN Guiding Principles (UNGPs from 2011), and as referenced by the OECD Guidelines (OECD from 2011).

Polaris legal structure and tax

Polaris has an on-shore legal structure based on legal entities registered in Denmark. Through our structure, and through we way we conduct our business, we seek to comply with Active Owners tax policy published on the 8th of June 2021.

Polaris revenues and remuneration structure

Polaris Management A/S is the fund manager of Polaris funds. For the services that we provide to these funds, we receive an annual fee. Polaris Management A/S is owned by the partners employed in the company. The employees in Polaris Management A/S receives renumeration as employees in Polaris Management A/S. Certain employees of Polaris Management A/S also invest in the funds through a carried interest program. Carried interest consists of financial instruments which provide a profit-sharing based on the returns of each fund, if these exceed a minimum hurdle rate. The investments made in the carried interest program are made at market value. Polaris’ carried interest program is fully in-line with market standards in the private equity industry.

The investors in Polaris funds

The investors in Polaris funds are reputable institutions based in the Nordics and throughout Europe. As part of their commitment as investors in Polaris funds, our investors accept our overall commitment to sustainability including, among other documents, our Responsible Investment Policy. Before being allowed to invest in Polaris funds, our investors are taken through an extensive Know-Your-Customer (“KYC”) process.

You can read more about Polaris current investors here.

Sustainability Regulations impacting Polaris

On March 10, 2021, the EU Commission’s Sustainable Finance Disclosure Regulation (EU) 2019/2088 (“the SFDR”) entered into force. As an AIFM, Polaris’ funds fall under SFDR and Polaris Management A/S ensures compliance with this regulation on behalf of Polaris active funds.

The SFDR sets new standards as to how financial market participants should report on sustainability relating to their financial products. With the SFDR, financial products are divided into categories with respect to their level of promotion of sustainability. These categories are defined as Article 6, 8 and 9 financial products. Article 6 products do not consider sustainability as a goal. Article 8 products consider sustainability as a goal, amongst other things, whereas Article 9 products consider sustainability as their primary goal. Article 8 and article 9 products are also termed as “light green” and “dark green” products, respectively.

The EU Taxonomy aims to establish a uniform framework as to how environmentally sustainable economic activities are defined. The SFDR specifies how to report on sustainability in the financial sector. When published in 2020, the EU Taxonomy made amendments to the SFDR, which means that parts of the disclosure regulation refer back to the EU Taxonomy. Hence, the two regulations are interrelated.

SFDR categorization of Polaris active funds

Polaris’ current approach to sustainability is applied to Polaris most recent active funds, their portfolio companies and our investment process but it is not applied retroactively to our earliest active fund. Based on our recent assessment of the SFDR, and the expected interpretation of this regulation, and our sustainability claims, we believe our active funds fall under the following categorization:

- Funds managed under Polaris Private Equity strategy (“PPE”)

- Fund III (Polaris Private Equity III K/S): SFDR – Article 6

- Fund IV (Polaris Private Equity IV K/S): SFDR – Article 8

- Fund V (Polaris Private Equity V K/S): SFDR – Article 8

- Funds managed under Polaris Flexible Capital strategy (“PFC”)

- PFC I: Polaris Flexible Capital I K/S: SFDR – Article 6

Polaris Management A/S will therefore align disclosures on behalf of the private equity Funds IV and V with the requirements for SFDR - Article 8 funds. Polaris private equity Fund III, launched in 2009, and Polaris flexible capital fund PFC I, launched in 2022, are SFDR – Article 6 funds, and we will comply with the related requlatory requirements.

Polaris sustainability claims – how we promote environmental and social objectives in our private equity strategy

Polaris main investment objective is to create financial return for our investors by investing in good companies with great potential. When seeking to realize our main objective and execute our strategy, we have a responsibility towards our many stakeholders are we are committed to promoting sustainability throughout Polaris to honor this responsibility. We work with sustainability for two reasons:

- It is a moral imperative – it is the right thing to do

- It is an integrated part of long-term value creation

Our commitment to sustainability is executed broadly throughout Polaris and affects our activities throughout our investment process, ownership and exit and covers all our investments. Within the scope of sustainability, we include social, environmental, and economic impacts according to the internationally agreed principles for sustainable development consisting of the UN Guiding Principles (UNGPs from 2011), and as referenced by the OECD Guidelines (OECD from 2011) and we refer to these as the basis for our “Sustainability Principles”. Our sustainability commitment and Sustainability Principles are described in Polaris Responsible Investment Policy (“RIP”). Our commitment to sustainability includes the promotion of both environmental and social objectives. We ensure that these objectives are reached by:

- Ensuring that each investment fulfills our defined investment criteria with respect to sustainability;

- Ensuring each portfolio company implements Polaris Sustainability Program and reaches a minimum level of infrastructure with respect to sustainability, including adherence to our Sustainability Principles (based on UN/OECD guidelines and management of adverse impacts);

- Ensure that each portfolio company works to improve their sustainability performance during our ownership.

The material sustainability related risks and opportunities for each of our investment opportunities and portfolio companies are unique. Which environmental and social factors that should be promoted and improved upon, and how these improvements should be measured, is therefore unique, and will be established on a case-by-case basis, for each portfolio company. We have however identified three focus areas within sustainability which we will work with across Polaris. These focus areas are also aligned with the Sustainable Development Goals (*SDG’s”) adopted by the United Nations in 2015. For each of these three areas, we will follow-up and report on progress and action taken, based upon the following key performance indicators (KPIs):

Focus Area - Climate Action: Action to combat climate change

KPI and measure of success: Reduction of carbon emission and/or carbon emission intensity (Scope 1,2 and 3)

Focus Area - Employer Responsibility: Action to secure a good working environment

KPI measure of success: limiting the level of, and swings in, employee-initiated staff turnover

Focus Area - Gender Equality: Action to promote gender equality

KPI measure of success: improvement of gender distribution in boards and management teams

We have not identified any general indices to measure our progress against, as our portfolio companies are active in a broad range of industries and geographies.

The EU Taxonomy offers a definition of what constitutes sustainable economic activities, and this definition is expanding to include more areas/sectors. As part of our work on sustainability, we will report on the EU Taxonomy eligibility and alignment of our portfolio companies as required by regulations and integrate this into our work. We have however not yet set any specific investment criteria or performance targets related to the EU Taxonomy.

The following sustainability criteria need to be met for an investment to be within Polaris’ investment mandate and for it to be considered an eligible investment for Polaris, from a sustainability perspective:

- The company is not part of, or has an important exposure to, a “no-go” sector: gambling, weapons, tobacco, and pornography

- The company does not have an unacceptable exposure to countries, persons, or entities on the UN sanctions list

- The risks of adverse impacts relating to Polaris’ target companies, as defined in our Sustainability Principles, are determined to be acceptable and manageable.

- The portfolio companies have processes, procedures, and policies in place to govern and manage sustainability and the company’s adverse impact, or we believe that we will be able to establish these, in collaboration with the management team, post-acquisition.

Polaris policies regarding sustainability

Our commitment to sustainability is set out and detailed in Polaris Responsible Investment Policy (“RIP”). Our RIP describes our work with sustainability in our private equity funds IV and V and how we work with sustainability in our flexible capital fund PFC I. Our commitment to sustainability is further elaborated in certain other Polaris policies: our Anti-Corruption Policy, Gender Equality Policy, Privacy Policy and Remuneration Policy. All of these documents are publicly available on our web-page.

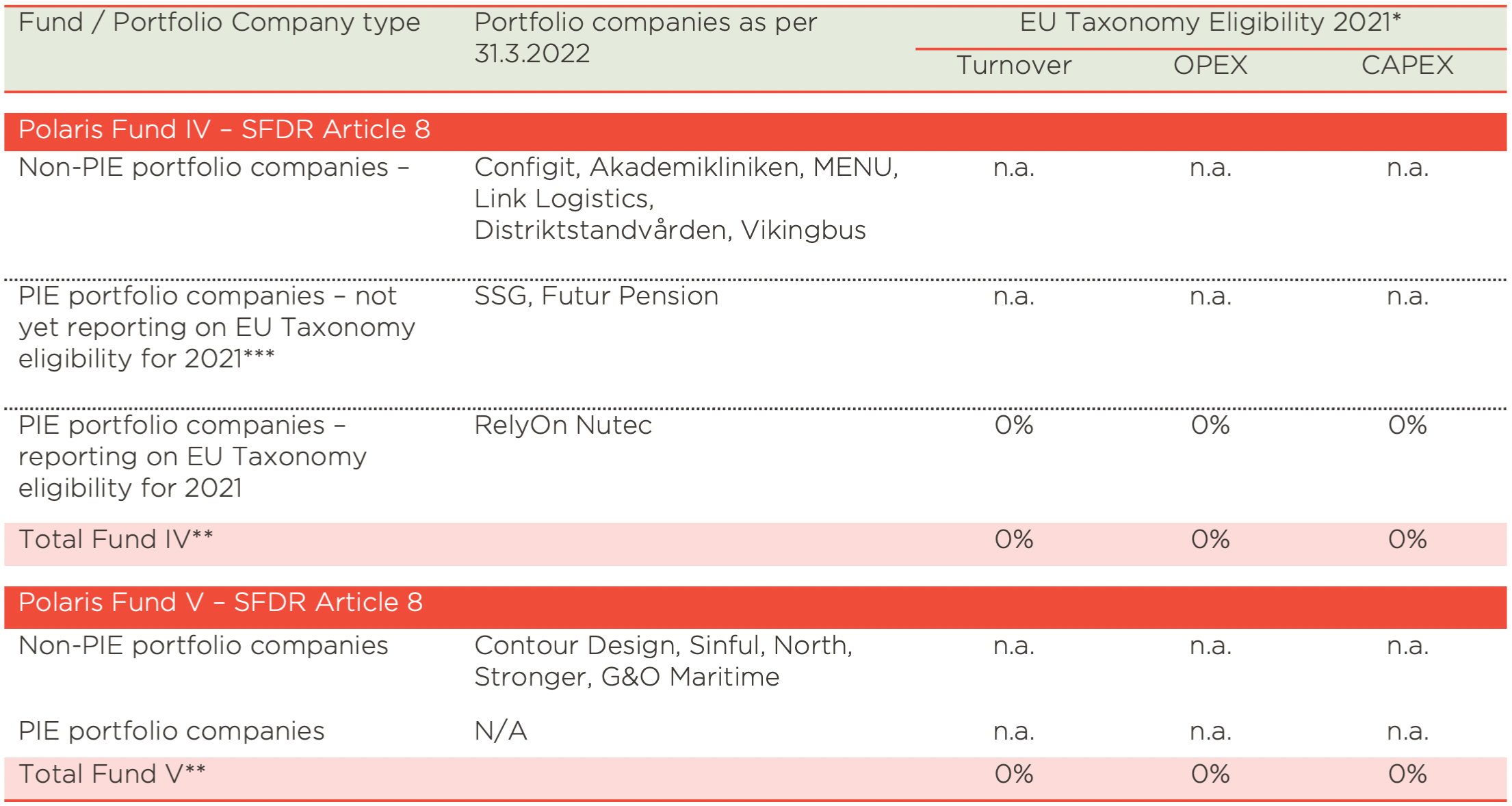

Proportion of investments in environmentally sustainable economic activities

The EU Taxonomy is a classification system which defines environmentally sustainable economic activities. Companies that are defined as Public Interest Entities (“PIE”) are obligated to report on EU Taxonomy eligibility for the year 2021 in 2022. Polaris is obligated to report on EU Taxonomy eligibility on behalf of our SFDR – Article 8 funds based on the portfolio companies in each of these funds.

** The turnover, OPEX and CAPEX of Non-PIE companies are included in the denominator

*** SSG’s EU Taxonomy eligibility will be addressed in the annual report for the financial year ending 30.9.2022. Futur Pension expect to start to report according to the EU Taxonomy in 2024 for the year ending 31.12.2023 as the Corporate Sustainability Reporting Directive (CSRD) comes into force.

Pre-contractual information

The opportunity to invest in Polaris funds is by invitation only. Current and historic fund-raising material (pre-contractual documentation) for Polaris’ funds is therefore not made publicly available by Polaris but only made available to prospective investors in Polaris funds, regulators and potential other stakeholders on special request.

Please refer to our contact page for press enquires or our compliance officer.

Integration of sustainability risks

A sustainability risk means “an environmental, social or governance (“ESG”) event or condition that, if it occurs, could cause an actual or potential material negative impact on the value of the investment”. Sustainability risks are integrated into the investment decisions of Polaris and are taken into account during the investment process in a manner proportionate to each product’s investment objective and in the same way as Polaris approaches other forms of risk management in relation to its products. This is done primarily as part of the due diligence process, whereby should an investment have a material exposure to a sustainability risk, Polaris may choose not to make an investment on this basis and in accordance with the relevant investment and risk management policies.

Statement of Principal Adverse Impacts (“PAI”)

As described in our Responsible Investment Policy, Polaris considers the principal adverse impact on sustainability factors that our investment decisions have. Polaris’ investment process consists of several pre-defined “gates”. The due diligence in the final gate consists of several aspects that are to be investigated for the target company. This includes an analysis of the investment from a sustainability perspective. The process is supported by reputable advisors in the area.

The principal adverse impacts are evaluated alongside all other risks and opportunities of a potential investment. If a particular investment fulfills our investment criteria, all risks and opportunities, hereunder sustainability related risks and opportunities, are then fully included in the business plan, the financial forecast and the overall valuation of the company.

Our portfolio companies shall, at a minimum, establish governance structures to meet the requirements embedded in our sustainability principles. These principles are founded on the UNGPs and the OECD’s guidelines that consist of a policy commitment to having a sustainability policy, sustainability due diligence processes, and grievance mechanisms. The key objective for Polaris is to create value and build a stronger company by active ownership through a structured value creation process, combined with an effective corporate governance structure. We address principal adverse impacts through our active ownership and investment restriction activities, as described in our Responsible Investment Policy.

How our private equity investments consider climate change mitigation and adaptation

Climate change mitigation means avoiding and reducing emissions of heat-trapping greenhouse gases into the atmosphere to prevent global warming. Climate change adaptation means altering our behaviour and systems to protect ourselves from the impacts of climate change (source: WWF).

Combating climate change is a focus area in our commitment to sustainability and as a part of this focus we attempt to consider both climate change mitigation and adaptation. To address mitigation, we measure and work to reduce greenhouse gas emissions throughout Polaris as part of our sustainability commitment.

To address climate change adaptation, we consider which investments that are, or will be, materially impacted by climate change and analyze their potential future climate-related risks and opportunities and how these can be addressed. We do this analysis based on the principles provided by the Task force on Climate related Financial Disclosures (“TCFD”), which we integrate into our sustainability strategy. We however not do TCFD reporting. The analysis of the climate-related risks and opportunities, based on the TCFD principles, are included into our overall assessment of potential investments, as part of our due diligence process, and it is part of Polaris Sustainability Program, which is implemented in our Portfolio Companies in the portfolio management phase.

Remuneration and sustainability risks

The boards of our portfolio companies must establish policies and systems that ensure board oversight with executive management, performance and remuneration reviews. Further, it must ensure legal compliance with respect to books, records, and accounting standards, effective internal controls, and solid risk management processes. Specifically, it is important that the remuneration of the management team and employees in the portfolio company does not encourage risk taking, including sustainability risks, beyond acceptable levels.

Periodic reporting on sustainability

Polaris reports on sustainability according to the regulations for the annual financial statements of Polaris Management A/S, Polaris’s funds and Polaris portfolio companies. In addition, Polaris annually publish Polaris Sustainability Report which is available on the web-page.

Financial reporting for Polaris Management and our funds

The financial report for Polaris Management A/S is available on here. An overview of the financial structure and development of Polaris funds is available in the Fund Administration document.